486BPOS: Post-effective amendment to filing filed pursuant to Securities Act Rule 486(b)

Published on April 28, 2023

THE SECURITIES ACT OF 1933 |

||||

Pre-Effective Amendment No. |

||||

Post-Effective Amendment No. |

Check box if the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans. |

Check box if any securities being registered on this Form will be offered on a delayed or continuous basis in reliance on Rule 415 under the Securities Act of 1933 (“Securities Act”), other than securities offered in connection with a dividend reinvestment plan. |

Check box if this Form is a registration statement pursuant to General Instruction A.2 or a post-effective amendment thereto. |

Check box if this Form is a registration statement pursuant to General Instruction B or a post-effective amendment thereto that will become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act. |

Check box if this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction B to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act. |

when declared effective pursuant to Section 8(c) of the Securities Act. |

immediately upon filing pursuant to paragraph (b) of Rule 486. |

on (date) pursuant to paragraph (b) of Rule 486. |

60 days after filing pursuant to paragraph (a) of Rule 486. |

on (date) pursuant to paragraph (a) of Rule 486. |

This [post-effective] amendment designates a new effective date for a previously filed [post-effective amendment] [registration statement]. |

This Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is: . |

This Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is: . |

☐ |

This Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is: . |

This Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is: . |

Registered Closed-End Fund (closed-end company that is registered under the Investment Company Act of 1940 (“1940 Act”)). |

Business Development Company (closed-end company that intends or has elected to be regulated as a business development company under the 1940 Act). |

Interval Fund (Registered Closed-End Fund or a Business Development Company that makes periodic repurchase offers under Rule 23c-3 under the 1940 Act). |

A.2 Qualified (qualified to register securities pursuant to General Instruction A.2 of this Form). |

Well-Known Seasoned Issuer (as defined by Rule 405 under the Securities Act). |

Emerging Growth Company (as defined by Rule 12b-2 under the Securities Exchange Act of 1934 (“Exchange Act”). |

If an Emerging Growth Company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. |

New Registrant (registered or regulated under the 1940 Act for less than 12 calendar months preceding this filing). |

| • | We have limited prior operating history and there is no assurance that we will achieve our investment objective. |

| • | This is a “blind pool” offering and thus you will not have the opportunity to evaluate our investments before we make them. |

| • | You should not expect to be able to sell your shares regardless of how we perform. |

| • | You should consider that you may not have access to the money you invest for an extended period of time. |

| • | We do not intend to list our shares on any securities exchange, and we do not expect a secondary market in our shares to develop prior to any listing. |

| • | Because you may be unable to sell your shares, you will be unable to reduce your exposure in any market downturn. |

| • | We have implemented a share repurchase program, but only a limited number of shares will be eligible for repurchase and repurchases will be subject to available liquidity and other significant restrictions. |

| • | An investment in our Common Shares is not suitable for you if you need access to the money you invest. See “Suitability Standards” and “Share Repurchase Program.” |

| • | You will bear substantial fees and expenses in connection with your investment. See “Fees and Expenses.” |

| • | We cannot guarantee that we will make distributions, and if we do we may fund such distributions from sources other than cash flow from operations, including, without limitation, the sale of assets, borrowings or return of capital, and we have no limits on the amounts we may pay from such sources. |

| • | Distributions may also be funded in significant part, directly or indirectly, from temporary waivers or expense reimbursements borne by the Adviser or its affiliates, that may be subject to reimbursement to the Adviser or its affiliates. The repayment of any amounts owed to the Adviser or its affiliates will reduce future distributions to which you would otherwise be entitled. |

| • | We use and continue to expect to use leverage, which will magnify the potential for loss on amounts invested and may increase the risk of investing in us. The risks of investment in a highly leverage fund include volatility and possible distribution restrictions. |

| • | We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our Common Shares less attractive to investors. |

| • | We intend to invest primarily in securities that are rated below investment grade by rating agencies or that would be rated below investment grade if they were rated. Below investment grade securities, which are often referred to as “junk,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may also be illiquid and difficult to value. |

Price to the Public (1)

|

Proceeds to Us, Before Expenses (2)

|

|||||||

Maximum Offering (3)

|

$ | 4,000,000,000 | $ | 4,000,000,000 | ||||

Class S Shares, per Share |

$ | 24.56 | $ | 1,000,000,000 | ||||

Class D Shares, per Share |

$ | 24.56 | $ | 1,000,000,000 | ||||

Class I Shares, per Share |

$ | 24.56 | $ | 1,000,000,000 | ||||

Class F Shares, per Share |

$ | 24.56 | $ | 1,000,000,000 | ||||

| (1) | Class S shares, Class D shares, Class I shares and Class F shares were initially offered at $25.00 per share, and are currently being offered on a monthly basis at a price per share equal to the NAV per share for such class. The table reflects the NAV per share of each class as of February 28, 2023. |

| (2) | No upfront sales load is paid with respect to Class S shares, Class D shares, Class I shares or Class F shares; however, if you buy Class S shares, Class D shares, Class I shares or Class F shares through certain financial intermediaries, they may directly charge you transaction or other fees, including upfront placement fees or brokerage commissions, in such amount as they may determine, provided that they limit such charges to a 3.5% cap on NAV for Class S shares, a 2.0% cap on NAV for Class D shares, a 2.0% cap on NAV for Class I shares and a 2.0% cap on NAV for Class F shares. We also pay the following shareholder servicing and/or distribution fees to the Managing Dealer and/or a participating broker, subject to Financial Industry Regulatory Authority, Inc. (“FINRA”) limitations on underwriting compensation: (a) for Class S shares, a shareholder servicing and/or distribution fee equal to 0.85% per annum of the aggregate NAV as of the beginning of the first calendar day of the month for the Class S shares, (b) for Class D shares, a shareholder servicing fee equal to 0.25% per annum of the aggregate NAV as of the beginning of the first calendar day of the month for the Class D shares, and (c) for Class F shares, a shareholder servicing and/or distribution fee equal to 0.50% per annum of the aggregate NAV as of the beginning of the first calendar day of the month for the Class F shares, in each case, payable monthly. No shareholder servicing or distribution fees are paid with respect to the Class I shares. The total amount that will be paid over time for other underwriting compensation depends on the average length of time for which shares remain outstanding, the term over which such amount is measured and the performance of our investments. We also pay or reimburse certain organization and offering expenses, including, subject to FINRA limitations on underwriting compensation, certain wholesaling expenses. See “Plan of Distribution” and “Use of Proceeds.” The total underwriting compensation and total organization and offering expenses will not exceed 10% and 15%, respectively, of the gross proceeds from this offering. Proceeds are calculated before deducting shareholder servicing or distribution fees or organization and offering expenses payable by us, which are paid over time. |

| (3) | The table assumes that all shares are sold in the primary offering, with 1/4 of the gross offering proceeds from the sale of Class S shares, 1/4 from the sale of Class D shares, 1/4 from the sale of Class I shares and 1/4 from the sale of Class F shares. The number of shares of each class sold and the relative proportions in which the classes of shares are sold are uncertain and may differ significantly from this assumption. |

| • | a gross annual income of at least $70,000 and a net worth of at least $70,000, or |

| • | a net worth of at least $250,000. |

| • | meets the minimum income and net worth standards established in the investor’s state; |

| • | can reasonably benefit from an investment in our Common Shares based on the investor’s overall investment objectives and portfolio structure; |

| • | is able to bear the economic risk of the investment based on the investor’s overall financial situation; and |

| • | has an apparent understanding of the following: |

| • | the fundamental risks of the investment; |

| • | the risk that the investor may lose its entire investment; |

| • | the lack of liquidity of our shares; |

| • | the background and qualification of our Adviser; and |

| • | the tax consequences of the investment. |

| iv | ||||

| vii | ||||

| vii | ||||

| vii | ||||

| 1 | ||||

| 26 | ||||

| 30 | ||||

| 32 | ||||

| 78 | ||||

| 81 | ||||

| 99 | ||||

| 113 | ||||

| 114 | ||||

| 152 | ||||

| 159 | ||||

| 162 | ||||

| 174 | ||||

| 183 | ||||

| 185 | ||||

| 187 | ||||

| 199 | ||||

| 201 | ||||

| 206 | ||||

| 209 | ||||

| 211 | ||||

| 213 | ||||

| 217 | ||||

| 224 | ||||

| 226 | ||||

| 226 | ||||

| 226 | ||||

| 226 | ||||

| 226 | ||||

| 227 | ||||

F-1 |

||||

A-1 |

Q: |

What is HPS Corporate Lending Fund (“HLEND”)? |

A: |

HLEND (or the Fund) is a fund externally managed by HPS Investment Partners, LLC (“HPS” or the “Adviser”) that seeks to invest primarily in newly originated senior secured debt and other securities of private U.S. companies within the upper middle market. We are a Delaware statutory trust and a non-diversified, closed-end management investment company that has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). We also intend to elect to be treated as a regulated investment company (“RIC”) under the Internal Revenue Code of 1986, as amended (the “Code”). |

Q: |

Who is HPS Investment Partners, LLC? |

A: |

HPS is a leading global credit-focused alternative investment firm with $97 billion of total assets under management as of January 1, 2023. HPS invests primarily in non-investment grade credit and manages various strategies across the capital structure that include privately negotiated senior debt; privately negotiated junior capital solutions in debt, preferred equity and common equity formats; liquid credit, including syndicated leveraged loans, collateralized loan obligations and high yield bonds; asset-based finance; and real estate. Established in 2007, HPS has 193 investment professionals and over 550 total employees and is headquartered in New York with fourteen additional offices globally as of December 31, 2022. HPS was established as a unit of Highbridge Capital Management, LLC (“HCM”), a subsidiary of J.P. Morgan Asset Management (“JPMAM”). In March 2016, the principals of HPS acquired HPS from JPMAM, which retained HCM’s hedge fund strategies. In June 2018, affiliates of Dyal Capital Partners, a division of Blue Owl Capital Inc., made a passive minority investment in HPS. In February 2022, an affiliate of The Guardian Life Insurance Company of America made a passive minority investment in HPS. |

Q: |

What is your investment objective? |

A: |

Our investment objective is to generate attractive risk-adjusted returns, predominately in the form of current income, with select investments exhibiting the ability to capture long-term capital appreciation. |

Q: |

What is your investment strategy? |

A: |

Our investment strategy focuses primarily on newly originated, privately negotiated senior credit investments in high-quality, established upper middle market companies and, in select situations, companies in special situations. We use the term “upper middle market companies” to generally mean companies with earnings before interest expense, income tax expense, depreciation and amortization (or “EBITDA”) of |

|

1 |

Data as of December 31, 2022. Based on all private credit investments (at committed cost) made since inception by funds and accounts across HPS’s Private Credit Platform, including Specialty Direct Lending, Core Senior Lending, Strategic Investment Partners, and HLEND strategies, as well as accounts that do not directly track the forementioned strategies but are part of HPS’s Private Credit Platform. |

| $75 million to $1 billion annually or $250 million to $5 billion in revenue annually, at the time of investment. We have and may continue to invest in smaller or larger companies if the opportunity presents attractive investment characteristics and risk-adjusted returns. While our investment strategy primarily focuses on companies in the United States, we also intend to leverage HPS’s global presence to invest in companies in Europe, Australia and other locations outside the U.S., subject to compliance with BDC requirements to invest at least 70% of assets in “eligible portfolio companies.” In addition to corporate level obligations, our investments in these companies may also opportunistically include private asset-based financings such as equipment financings, financings against mission-critical corporate assets and mortgage loans. We may also selectively make investments that represent equity in portfolios of loans, receivables or other debt instruments. We may also participate in programmatic investments in partnership with one or more unaffiliated banks or other financial institutions, where our partner assumes senior exposure to each investment, and we participate in the junior exposure. |

Q: |

What types of investments do you make? |

A: |

Under normal circumstances, we invest at least 80% of our total assets (net assets plus borrowings for investment purposes) in credit and credit-related instruments issued by corporate issuers (including loans, notes, bonds and other corporate debt securities). |

Q: |

What is an originated loan? |

A: |

An originated loan is a loan where we lend directly to the borrower and hold the loan generally on our own or in a small group with other HPS advised funds and accounts and/or third-party investors. This is distinct from a syndicated loan, which is generally originated by a bank and then syndicated, or sold, in several pieces to other investors. |

Q: |

Why do you invest in liquid credit investments in addition to originated loans? |

A: |

The allocation to liquid credit investments within the Fund’s portfolio is expected to (i) provide the Fund with sufficient liquidity in order to meet the Fund’s share repurchase requirements, and (ii) allow the Fund to seek attractive investment returns prior to investing subscription proceeds into newly originated loans. |

Q: |

What potential competitive strengths does the Adviser offer? |

A: |

HPS is a leading global, credit-focused alternative investment firm that seeks to provide creative capital solutions and generate attractive risk-adjusted returns for its clients. The scale and breadth of HPS’s platform offers the flexibility to invest in companies large and small across the capital structure through both standard and highly customized structures. At its core, HPS shares a common thread of intellectual rigor and investment discipline that enables it to create value for its clients, who have entrusted HPS with approximately $97 billion of assets under management as of January 1, 2023. |

| • | Scaled Capital with an Ability to Speak for the Full Debt Quantum |

|

2 |

Data as of December 31, 2022. Based on all private credit investments (at committed cost) made since inception by funds and accounts across HPS’s Private Credit Platform, including Specialty Direct Lending, Core Senior Lending, Strategic Investment Partners and HLEND strategies, as well as accounts that do not directly track the forementioned strategies but are part of HPS’s Private Credit Platform. |

allows it to commit to loans of up to approximately $1 billion. HPS believes that there is a finite set of competitors who can provide and solely hold investments of this size and service these larger scale borrowers. HPS believes that many borrowers in this segment value the confidentiality, efficiency and execution certainty available in the private credit market. HPS also believes that being the sole or majority investor in a debt tranche can also provide the funds it advises with enhanced downside protection. Additionally, due to favorable competitive dynamics with fewer capital providers with the ability to deliver scaled capital solutions, HPS believes that the HPS Direct Lending platform has, to date, been successful in capturing attractive risk-adjusted returns for providing solutions to larger, more diversified borrowers. Having the scale to provide a complete capital solution to larger borrowers has also been an important factor in HPS’s ability to make investments in an increasingly competitive market environment. |

| • | Diversified Sourcing Network 3 HPS believes that its ability to source from non-sponsor channels significantly reduces the level of competitive intensity and allows it to focus on structuring improved economics, stricter financial covenants and stronger loan documentation. In addition, the direct dialogue with management teams can result in a better understanding of the underlying borrowers and better positioning to actively manage investments throughout their life. HPS is also actively engaged with financial sponsors, and its exposure to sponsor transactions tends to increase in times of public market dislocation (when certainty of capital and speed of execution with a single counterparty is often sought after and highly valued). HPS believes that the ability to flex in and out of both sponsor and non-sponsor markets allows the Fund to remain nimble and optimize its opportunity set across different market dynamics. While HPS seeks to source investments from non-sponsor channels for the Fund, as of December 31, 2022, the Fund has sourced only a minority of its overall private credit investments from non-sponsor channels. The Fund may not, in the future, obtain its desired allocation to investments from the non-sponsor channel, which could adversely impact returns. |

| • | Breadth of HPS’s Credit Investment Platform non-investment grade credit opportunities across the capital structure. As a multi-strategy credit platform, seeking opportunities across both private and liquid credit, HPS employs an open-architecture framework under which investment teams can apply shared knowledge and insights when evaluating new investment opportunities. HPS’s team of 193 investment professionals managed approximately $97 billion as of January 1, 2023. HPS believes that its multi-strategy approach provides a differentiated vantage point to evaluate relative value and better positions the firm to provide borrowers with a comprehensive and diverse set of potential financing solutions, which may enable the Fund to see more investment opportunities. In addition, HPS believes that its global footprint enables the Fund to view and potentially benefit from relative value opportunities across geographies. |

| • | Willingness to Navigate Complexity to Evaluate a Mispriced Opportunity. |

|

3 |

As of December 31, 2022. Based on all investments made since inception by funds and accounts across HPS’s Direct Lending Platform, including Specialty Direct Lending, Core Senior Lending and HLEND strategies. |

with the requisite expertise to underwrite these investment opportunities and borrowers tend to be more willing to pay for secured financing. HPS seeks to use its understanding of market structures to pursue these investment opportunities, identifying structures or deal dynamics that dissuade competing capital that view the opportunities as more “complex.” HPS believes that addressing complexity through creative pricing and structure can generate potential investment opportunities that can offer attractive, uncorrelated returns taking into account the additional work that is required. Leveraging HPS’s multi-strategy approach to credit may provide the Fund with distinctive vantage points in determining the relative value of, as well as insight into appropriately pricing, the investment opportunity in light of the risk. HPS believes that the capability to navigate complexity to identify a potentially mispriced investment opportunity is important in environments where volatility and uncertainty around economic growth is common. |

| • | Focus on the Upper Middle Market upper-end of the middle market. As HPS believes that the market is in its later stages of the existing credit cycle, HPS intends to position the portfolio by focusing on larger, more resilient companies that generally generate $75 million to $1 billion of EBITDA annually or $250 million to $5 billion in revenue annually. In comparison, the S&P LCD definition of middle market is defined as companies with $50 million of EBITDA or less. HPS believes the upper end of the middle market has a favorable supply/demand dynamic, with substantial demand resulting from regulatory driven structural shifts in the financial landscape and limited supply as most other direct lending providers focus on small to middle market borrowers. HPS also believes that this segment of the market can offer greater downside protection, as larger businesses typically possess the benefits of scale and a greater critical mass through diversification of customers and supplier base. As a result of these dynamics, HPS believes that it can generally negotiate commensurate or better terms with respect to borrowers in that segment and that those borrowers can provide the Fund with increased downside protection, resulting in attractive risk-adjusted returns compared to the smaller-end and core-middle market. |

| • | Emphasis on Capital Preservation. |

Q: |

What is the market opportunity? |

A: |

Private credit as an asset class has grown considerably since the global financial crisis of 2008, and it is estimated that the total market size of private credit has grown five-fold to reach $1.2 trillion in 2021 4 . We expect this growth to continue and, along with the factors outlined below, to provide a robust backdrop to what HPS believes will be a significant number of attractive investment opportunities aligned to our investment strategy. |

| • | Senior Secured Loans Offer Attractive Investment Characteristics |

|

4 |

Source: Preqin, Private Debt global AUM tracked as of December 31, 2021. |

discount, closing payments, commitment fees, SOFR (or similar rate) floors, call protection, and/or prepayment penalties and related fees that are additive components of total return. The relative seniority and security of a senior secured loan, coupled with the privately negotiated nature of direct lending, help mitigate downside risk. These attributes have contributed to senior secured loans’ comparatively strong record of recovery after a default, as such loans have historically realized a higher recovery rate than unsecured parts of an issuer’s capital structure. 5 |

| • | Regulatory Actions Continue to Drive Demand towards Private Financing. non-investment grade credit commitments on their balance sheets, particularly with respect to middle and upper middle market-sized issuers. Instead, many commercial banks have adopted an “underwrite-and-distribute” 6 . Access to the syndicated leveraged loan market has also become challenging for both first time issuers and smaller scale issuers, who previously had access to the capital markets. Issuers of tranche sizes representing less than $500 million account for approximately 7% of the new issue market as of December 31, 2022 as compared to over 49% in 20007 . HPS believes that these regulatory actions have caused a shift in the role that commercial banks play in the direct lending market for middle to upper middle market borrowers, creating a void in the financing marketplace. This void has been filled by direct lending platforms which seek to provide borrowers an alternative “originate and retain” solution. In response, corporate borrower behavior has increasingly shifted to a more conscious assessment of the benefits that direct lending platforms of strategic financing partners can offer. |

| • | Volatility in Credit Markets has made Availability of Capital Less Predictable. |

| • | Increasingly Larger Borrowers Are Finding Value in Private Solutions |

|

5 |

Source: Moody’s Investors Service Ultimate Recovery Rates Data; “Corporate Defaults and Recoveries—US” as of May 18, 2021. |

|

6 |

Source: S&P LCD Quarterly Leveraged Lending Review 4Q 2022, Primary Investor Market: Banks vs. Non-bank. |

|

7 |

Source: S&P LCD Middle Market Deal Size Category Factsheet 4Q 2022. |

against public market alternatives for larger companies. HPS believes the benefits of this growing opportunity set at the upper end of the market will accrue to the largest direct lending players, like HPS, as scale is a prerequisite for providing certainty. |

Q: |

How do you identify investments? |

A: |

We believe that much of the value HPS creates for our private investment portfolio comes on the front end through the diversity of its sourcing capabilities. To source transactions, HPS leverages the breadth of its global credit platform and its shared knowledge and insights gleaned across both private and public credit to cast a wide net to drive transaction flow. HPS seeks to generate investment opportunities across its various sourcing channels, including financial intermediaries such as investment banks and debt advisory firms, direct relationships with companies and management teams, private equity sponsors and formal partnerships and strategic arrangements with select financial institutions. We believe that this multi-pronged approach to sourcing provides a significant pipeline of investment opportunities for us that could contribute to our portfolio with attractive investment economics and risk/reward profile. |

Q: |

How do you evaluate and manage directly originated investments? |

A: |

HPS evaluates and manages directly originated investments by adhering to the core principles of rigorous fundamental analysis, thorough due diligence, active portfolio monitoring and risk management. |

| • | Rigorous Investment Screening and Selection. e.g. value-add products or services). When evaluating a loan, our investment team (the “Investment Team”) expects to focus on a combination of business stability, asset values and contractual loan protections. This process seeks to prioritize the Investment Team’s time spent and resources allocated by focusing on screening for opportunities where the borrower may place greater emphasis on certain non-economic characteristics, such as certainty of scaled capital, creative financing solutions, an ability to understand complexity of capital structure or business risk and/or confidentiality of operating and financial performance. HPS believes that when facing these characteristics, we have a competitive edge over certain syndicated financing solutions or other competitive direct lending platforms (both of which typically have a lower cost of capital). This rigorous selection process helps the Investment Team focus on situations where the Adviser believes we have a competitive edge to capitalize on an investment opportunity. |

| • | Fundamental Analysis and Due Diligence. in-depth due diligence and full credit analysis on transaction drivers, investment thesis, review of business, industry and borrower risks and mitigants, undertaking a competitive analysis, management calls/meetings, reviewing and performing financial analysis of historical results, preparing detailed models with financial forecasts, examining legal structure/terms/collateral, performing relative value analysis, employing external consultants and/or other considerations that the Investment Team deems appropriate. HPS generally seeks to employ a “cradle to grave” approach with respect to its investments such that the Investment Team is responsible for sourcing the investment, investment due diligence, and monitoring the investment until the investment is exited. HPS believes that this is a distinctive approach that can lead to (i) greater connectivity between HPS and a borrower’s |

management teams, (ii) enhanced access to the borrower details and (iii) increased accountability to help reduce the inherent risk of knowledge loss in circumstances where the sourcing, diligence and monitoring roles are fragmented. |

| • | Structuring and Negotiating Downside Protection Mechanisms. |

| • | Disciplined Approach. |

Q: |

How are investments allocated to the Fund? |

A: |

HPS provides investment management services to investment funds and client accounts. HPS shares any investment and sale opportunities with its other clients and us in accordance with applicable law, including the Investment Advisers Act of 1940, as amended (the “Advisers Act”), firm-wide allocation policies, and an exemptive order from the SEC permitting co-investment activities (as further described below), which generally provide for sharing eligible investments pro rata |

Q: |

Does the Fund use leverage? |

A: |

Yes, we currently use and intend to continue to use leverage to seek to enhance our returns. Our leverage levels will vary over time in response to general market conditions, the size and compositions of our investment portfolio and the views of our Adviser and Board. We expect that our debt to equity ratio will generally range between 1.0x and 1.25x. While our leverage employed may be greater or less than these levels from time to time, it will never exceed the limitations set forth in the 1940 Act, which currently allows us to borrow up to a 2:1 debt to equity ratio. |

Q: |

What is a BDC? |

A: |

Congress created the business development company, or BDC, through the Small Business Investment Incentive Act of 1980 to facilitate capital investment in small and middle market companies. Closed-end investment companies organized in the U.S. that elect to be treated as BDCs under the 1940 Act are subject to specific provisions of the law, most notably that at least 70% of their total assets must be “qualifying assets”. Qualifying assets are generally defined as privately offered debt or equity securities of U.S. private companies or U.S. publicly traded companies with market capitalizations less than $250 million. |

Q: |

What is a non-exchange traded, perpetual-life BDC? |

A: |

A non-exchange traded BDC’s shares are not listed for trading on a stock exchange or other securities market. The term “perpetual-life” is used to differentiate our structure from other BDCs who have a finite offering period and/or have a predefined time period to pursue a liquidity event or to wind down the fund. In contrast, in a perpetual-life BDC structure like ours, we expect to offer common shares continuously at a price equal the monthly net asset value (“NAV”) per share and we have an indefinite duration, with no obligation to effect a liquidity event at any time. We generally intend to offer our common shareholders an opportunity to have their shares repurchased on a quarterly basis, subject to an aggregate cap of 5% of shares outstanding. However, the determination to repurchase shares in any given quarter is fully at the Board’s discretion, so investors may not always have access to liquidity when they desire it. See “Risk Factors.” |

Q: |

How does an investment in HLEND differ from an investment in a listed BDC or private BDC with a finite life? |

A: |

An investment in our common shares of beneficial interest (“Common Shares”) differs from an investment in a listed or exchange traded BDC in several ways, including: |

| • | Pricing. |

| • | Liquidity |

| • | Oversight non-traded BDCs are subject to the requirements of the 1940 Act and the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Unlike the offering of a listed BDC, the Fund’s offering will be registered in every state in which we are offering and |

selling shares. As a result, we include certain limits in our governing documents that are not typically provided for in the charter of a listed BDC. For example, our Declaration of Trust (as amended or restated from time to time, the “Declaration of Trust”) limits the fees we can pay to the Adviser. |

| • | Eligible Investors. |

| • | Investment funding |

| • | Investment period. |

A: |

An investment in our shares may be appropriate for you if you: |

| • | meet the minimum suitability requirements described under “Suitability Standards” above, which generally require that a potential investor has either (i) both net worth and annual net income of $70,000 or (ii) net worth of at least $250,000; |

| • | seek to allocate a portion of your financial assets to a direct investment vehicle with an income-oriented portfolio of primarily U.S. credit investments; |

| • | seek to receive current income through regular distribution payments while obtaining the potential benefit of long-term capital appreciation; and |

| • | can hold your shares as a long-term investment without the need for near-term or rapid liquidity. |

Q: |

Is HPS investing in the Fund? |

A: |

Yes, HPS, its affiliates and employees plan to invest up to $25 million in our Common Shares. As of December 31, 2022, HPS, its affiliates and employees held approximately $17.4 million of our Common Shares. |

Q: |

Is there any minimum investment required? |

A: |

Yes, to purchase Class S, Class D or Class F shares in this offering, you must make a minimum initial investment in our Common Shares of $2,500. To purchase Class I shares in this offering, you must make a minimum initial investment of $1,000,000, unless waived or reduced by the Managing Dealer. The Managing Dealer waives or reduces to $10,000 or less Class I investment minimums for certain categories of investors. See “Plan of Distribution.” All subsequent purchases of Class S, Class D, Class F or Class I shares, except for those made under our distribution reinvestment plan, are subject to a minimum investment size of $500 per transaction. The Managing Dealer can waive the initial or subsequent minimum investment at its discretion. |

Q: |

How is the Fund’s value established? |

A: |

The Fund’s NAV is determined based on the value of our assets less the carrying value of our liabilities, including accrued fees and expenses, as of any date of determination. |

Q: |

How can I purchase shares? |

A: |

Subscriptions to purchase our Common Shares may be made on an ongoing basis, but investors may only purchase our Common Shares pursuant to accepted subscription orders as of the first business day of each month. A subscription must be received in good order at least five business days prior to the first business day of the month (unless waived by the Managing Dealer) and include the full subscription funding amount to be accepted. |

Q: |

When will my subscription be accepted? |

A: |

Completed subscription requests will not be accepted by us any earlier than two business days before the first day of each month. |

Q: |

Can I withdraw a subscription to purchase shares once I have made it? |

A: |

Yes, you may withdraw a subscription after submission at any time before we have accepted the subscription, which we will generally not do any earlier than two business days before the first day of each month. You may withdraw your purchase request by notifying the transfer agent, through your financial intermediary or directly on the toll-free, automated telephone line at 1-888-484-1944. |

Q: |

What is the per share purchase price? |

Q: |

When is the NAV per share available? |

A: |

We report our NAV per share as of the last day of each month on our website within 20 business days of the last day of each month. Because subscriptions must be submitted at least five business days prior to the first day of each month, you will not know the NAV per share at which you will be subscribing at the time you subscribe. |

Q: |

Can I invest through my Individual Retirement Account (“IRA”), Simplified Employee Pension Plan (“SEP”) or other after-tax deferred account? |

A: |

Yes, if you meet the suitability standards described under “Suitability Standards” above, you may invest via an IRA, SEP or other after-tax deferred account. If you would like to invest through one of these account types, you should contact your custodian, trustee or other authorized person for the account to subscribe. They will process the subscription and forward it to us, and we will send the confirmation and notice of our acceptance back to them. |

Q: |

How often does the Fund pay distributions? |

A: |

We have declared distributions each month beginning in February 2022 through the date of this prospectus and expect to continue to pay regular monthly distributions. Any distributions we make will be at the discretion of our Board, who will consider, among other things, our earnings, cash flow, capital needs and general financial condition, as well as our desire to comply with the RIC requirements, which generally require us to make aggregate annual distributions to our shareholders of at least 90% of our net investment income. As a result, our distribution rates and payment frequency may vary from time to time and there is no assurance we will pay distributions in any particular amount, if at all. See “Description of our Common Shares” and “Certain U.S. Federal Income Tax Considerations.” |

Q: |

Can I reinvest distributions in the Fund? |

A: |

Yes, we have adopted a distribution reinvestment plan whereby shareholders (other than those located in specific states or who are clients of selected participating brokers, as outlined below) will have their cash distributions automatically reinvested in additional shares of the same class of our Common Shares to which the distribution relates unless they elect to receive their distributions in cash. The purchase price for shares purchased under our distribution reinvestment plan will be equal to the then current NAV per share of the relevant class of Common Shares. Shareholders will not pay transaction related charges when purchasing shares under our distribution reinvestment plan, but all outstanding Class S, Class D and Class F shares, including those purchased under our distribution reinvestment plan, will be subject to ongoing servicing fees. |

Q: |

How can I change my distribution reinvestment plan election? |

A: |

Participants may terminate their participation in the distribution reinvestment plan or shareholders may elect to participate in our distribution reinvestment plan with five business days’ prior written notice by contacting our Transfer Agent, U.S. Bancorp Fund Services, LLC (d/b/a U.S. Bank Global Fund Services) (“U.S. Bank Global Fund Services”), at HPS Corporate Lending Fund, c/o U.S. Bank Global Fund Services, 615 East Michigan Street, Milwaukee, WI 53202. |

Q: |

How will distributions be taxed? |

A: |

We intend to elect to be treated for federal income tax purposes, and intend to qualify annually thereafter, as a RIC under the Code. A RIC is generally not subject to U.S. federal corporate income taxes on the net taxable income that it currently distributes to its shareholders. |

Q: |

Can I sell, transfer or otherwise liquidate my shares post purchase? |

A: |

The purchase of our Common Shares is intended to be a long-term investment. We do not intend to list our shares on a national securities exchange, and do not expect a public market to develop for our shares in the foreseeable future. We also do not intend to complete a liquidity event within any specific period, and there can be no assurance that we will ever complete a liquidity event. We intend to conduct quarterly share repurchase offers in accordance with the 1940 Act to provide limited liquidity to our shareholders. Our share repurchase program will be the only liquidity initiative that we offer to our shareholders. |

Q: |

Can I request that my shares be repurchased? |

A: |

Yes, subject to limitations. We have commenced a share repurchase program pursuant to which we intend to conduct quarterly repurchase offers to allow our shareholders to tender their shares at a price equal to the NAV per share for the applicable class of shares on each date of repurchase. Our Board may amend, suspend or terminate the share repurchase program at any time if it deems such action to be in our best interest and the best interest of our shareholders. As a result, share repurchases may not be available each quarter. Upon a suspension of our share repurchase program, our Board will consider at least quarterly whether the continued suspension of our share repurchase program remains in our best interest and the best interest of our shareholders. However, our Board is not required to authorize the recommencement of our share repurchase program within any specified period of time. Our Board may also determine to terminate our share repurchase program if required by applicable law or in connection with a transaction in which our shareholders receive liquidity for their Common Shares, such as a sale or merger of the Fund or listing of our Common Shares on a national securities exchange. |

Q: |

What fees do you pay to the Adviser? |

A: |

Pursuant to the advisory agreement between us and the Adviser (the “Advisory Agreement”), the Adviser is responsible for, among other things, identifying investment opportunities, monitoring our investments and determining the composition of our portfolio. We pay the Adviser a fee for its services under the Advisory Agreement consisting of two components: a management fee and an incentive fee. |

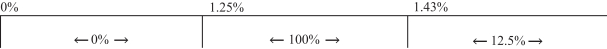

| • | The management fee is payable monthly in arrears at an annual rate of 1.25% of the value of our net assets as of the beginning of the first calendar day of the applicable month. |

| • | The incentive fee consists of two components as follows: |

| • | The first part of the incentive fee is based on income, whereby we pay the Adviser quarterly in arrears 12.5% of its Pre-Incentive Fee Net Investment Income Returns (as defined below) for each calendar quarter subject to a 5.0% annualized hurdle rate, with a catch-up. |

| • | The second part of the incentive fee is based on realized capital gains, whereby we pay the Adviser at the end of each calendar year in arrears 12.5% of cumulative realized capital gains from inception through the end of such calendar year, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid incentive fee on capital gains. |

Q: |

How will I be kept up to date about how my investment is doing? |

A: |

We and/or your financial advisor, participating broker or financial intermediary, as applicable, will provide you with periodic updates on the performance of your investment with us, including: |

| • | three quarterly financial reports and an annual report; |

| • | quarterly investor statements; |

| • | in the case of certain U.S. shareholders, an annual Internal Revenue Service (“IRS”) Form 1099-DIV or IRS Form 1099-B, if required, and, in the case of non-U.S. shareholders, an annual IRS Form 1042-S; and |

| • | confirmation statements (after transactions affecting your balance, except reinvestment of distributions in us and certain transactions through minimum account investment or withdrawal programs). |

Q: |

What type of tax reporting will I receive on the Fund, and when will I receive it? |

A: |

As promptly as possible after the end of each calendar year, we intend to send to each of our U.S. shareholders an annual IRS Form 1099-DIV or IRS Form 1099-B, if required, and, in the case of non-U.S. shareholders, an annual IRS Form 1042-S. |

Q: |

What are the tax implications for non-U.S. investors in the Fund? |

A: |

Because we are a corporation for U.S. federal income tax purposes, a non-U.S. investor in the Fund will generally not be treated as engaged in a trade or business in the U.S. solely as a result of investing in the Fund, unless the Fund is treated as a “United States real property holding corporation” for U.S. federal income tax purposes. Although there can be no assurance in this regard, we do not currently expect to be a United States real property holding corporation for U.S. federal income tax purposes. |

Q: |

What are the tax implications for non-taxable U.S. investors in the Fund? |

A: |

Because we are a corporation for U.S. federal income tax purposes, U.S. tax-exempt investors in the Fund will generally not derive “unrelated business taxable income” for U.S. federal income tax purposes (“UBTI”) solely as a result of their investment in the Fund. A U.S. tax-exempt investor, however, may derive UBTI from its investment in the Fund if the investor incurs indebtedness in connection with its purchase of shares in the Fund. Tax-exempt investors should consult their tax advisors with respect to the consequences of investing in the Fund. |

Q: |

What is the difference between the four classes of Common Shares being offered? |

A: |

We are offering to the public four classes of Common Shares—Class S shares, Class D shares, Class I shares and Class F shares. The differences among the share classes relate to ongoing shareholder servicing and/or distribution fees, with Class S shares, Class D shares and Class F shares subject to ongoing and shareholder servicing and/or distribution fee of 0.85%, 0.25% and 0.50%, respectively and Class I shares not subject to a shareholder servicing and/or distribution fee. In addition, although no upfront sales loads are paid with respect to Class S shares, Class D shares, Class I shares or Class F shares, if you buy Class S shares, Class D shares, Class I shares or Class F shares through certain financial |

Annual Shareholder Servicing and/or Distribution Fees |

Total Over Five Years |

|||||||

Class S |

$ | 85 | $ | 425 | ||||

Class D |

$ | 25 | $ | 125 | ||||

Class I |

$ | 0 | $ | 0 | ||||

Class F |

$ | 50 | $ | 250 | ||||

Q: |

Are there ERISA considerations in connection with investing in the Fund? |

A: |

We intend to conduct our affairs so that our assets should not be deemed to constitute “plan assets” under the ERISA, and certain U.S. Department of Labor regulations promulgated thereunder, as modified by Section 3(42) of ERISA (the “Plan Asset Regulations”). In this regard, generally, we intend to take one of the following approaches: (1) in the event that each class of Common Shares is considered a “publicly-offered security” within the meaning of the Plan Asset Regulations (“Publicly-Offered Security”), we will not limit “benefit plan investors” from investing in the Common Shares, and (2) in the event one or more classes of Common Shares does not constitute a Publicly-Offered Security, (a) we will limit investment in each class of Common Shares by “benefit plan investors” to less than 25% of the total value of each class of our Common Shares, within the meaning of the Plan Asset Regulations (including any class that constitutes a Publicly-Offered Security), or (b) we will prohibit “benefit plan investors” from owning any class that does not constitute a Publicly-Offered Security. |

Q: |

What is the role of the Fund’s Board of Trustees? |

A: |

We operate under the direction of our Board, the members of which are accountable to us and our shareholders as fiduciaries. We have six Trustees, four of whom have been determined to be independent of us, the Adviser and its affiliates (“Independent Trustees”). Our Independent Trustees are responsible for, among other things, reviewing the performance of the Adviser, approving the compensation paid to the Adviser and its affiliates, oversight of the valuation process used to establish the Fund’s NAV and oversight of the investment allocation process to the Fund. The names and biographical information of our Trustees are provided under “Management of the Fund—Trustees and Executive Officers.” |

Q: |

Are there any risks involved in buying your shares? |

A: |

Investing in our Common Shares involves a high degree of risk. If we are unable to effectively manage the impact of these risks, we may not meet our investment objective and, therefore, you should purchase our shares only if you can afford a complete loss of your investment. An investment in our Common Shares involves significant risks and is intended only for investors with a long-term investment horizon and who do not require immediate liquidity or guaranteed income. Some of the more significant risks relating to an investment in our Common Shares include those listed below: |

| • | We have limited prior operating history and there is no assurance that we will achieve our investment objective. |

| • | This is a “blind pool” offering and thus you will not have the opportunity to evaluate our investments before we make them. |

| • | You should not expect to be able to sell your shares regardless of how we perform. |

| • | You should consider that you may not have access to the money you invest for an extended period of time. |

| • | We do not intend to list our shares on any securities exchange, and we do not expect a secondary market in our shares to develop prior to any listing. |

| • | Because you may be unable to sell your shares, you will be unable to reduce your exposure in any market downturn. |

| • | We have implemented a share repurchase program, but only a limited number of shares will be eligible for repurchase and repurchases will be subject to available liquidity and other significant restrictions. |

| • | An investment in our Common Shares is not suitable for you if you need access to the money you invest. See “Suitability Standards” and “Share Repurchase Program.” |

| • | You will bear substantial fees and expenses in connection with your investment. See “Fees and Expenses.” |

| • | We cannot guarantee that we will make distributions, and if we do we may fund such distributions from sources other than cash flow from operations, including, without limitation, the sale of assets, borrowings or return of capital, and we have no limits on the amounts we may pay from such sources. A return of capital (1) is a return of the original amount invested, (2) does not constitute earnings or profits and (3) will have the effect of reducing a shareholder’s tax basis such that when a shareholder sells its shares the sale may be subject to taxes even if the shares are sold for less than the original purchase price. |

| • | Distributions may also be funded in significant part, directly or indirectly, from temporary waivers or expense reimbursements borne by the Adviser or its affiliates, that may be subject to reimbursement to the Adviser or its affiliates. The repayment of any amounts owed to the Advisor or its affiliates will reduce future distributions to which you would otherwise be entitled. |

| • | We use and continue to expect to use leverage, which will magnify the potential for loss on amounts invested and may increase the risk of investing in us. The risks of investment in a highly leverage fund include volatility and possible distribution restrictions. |

| • | We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”), and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our Common Shares less attractive to investors. |

| • | We intend to invest primarily in securities that are rated below investment grade by rating agencies or that would be rated below investment grade if they were rated. Below investment grade securities, which are often referred to as “junk,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may also be illiquid and difficult to value. |

Q: |

Do you currently own any investments? |

A: |

Yes. Please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” the financial statements included herein, our periodic reports under the Exchange Act and www.hlend.com |

Q: |

What is a “best efforts” offering? |

A: |

Our Common Shares are offered on a “best efforts” basis. A “best efforts” offering means the Managing Dealer and the participating brokers are only required to use their best efforts to sell the shares. When shares are offered to the public on a “best efforts” basis, no underwriter, broker or other person has a firm commitment or obligation to purchase any of the shares. Therefore, we cannot guarantee that any minimum number of shares will be sold. |

Q: |

What is the expected term of this offering? |

A: |

We have registered a total of $4,000,000,000 in Common Shares and have sold approximately $3,700,000,000 in Common Shares as of the date of this prospectus. It is our intent, however, to conduct a continuous offering for an extended period of time, by filing for additional offerings of our shares, subject to regulatory approval and continued compliance with the rules and regulations of the SEC and applicable state laws. |

Q: |

What is a regulated investment company, or RIC? |

A: |

We intend to elect to be treated for federal income tax purposes, and intend to qualify annually thereafter, as a regulated investment company (a “RIC”) under the Internal Revenue Code of 1986, as amended (the “Code”). |

| • | is a BDC or registered investment company that combines the capital of many investors to acquire securities; |

| • | offers the benefits of a securities portfolio under professional management; |

| • | s |

| • | is generally not subject to U.S. federal corporate income taxes on its net taxable income that it currently distributes to its shareholders, which substantially eliminates the “double taxation” ( i.e. |

Q: |

Who administers the Fund? |

A: |

HPS, in its capacity as our administrator (the “Administrator”), provides or oversees the performance of administrative and compliance services. We reimburse the Administrator for its costs, expenses and our allocable portion of compensation (including salaries, bonuses and benefits) of the Administrator’s personnel and the Administrator’s overhead (including rent, office equipment and utilities) and other expenses incurred by the Administrator in performing its administrative obligations under the administration agreement (the “Administration Agreement”). See “Advisory Agreement and Administration Agreement—Administration Agreement.” |

Q: |

What are the offering and servicing costs? |

A: |

No upfront sales load is paid with respect to Class S shares, Class D shares, Class I or Class F shares; however, if you buy Class S shares, Class D shares, Class I shares or Class F shares through certain financial intermediaries, they may directly charge you transaction or other fees, including upfront placement fees or brokerage commissions, in such amount as they may determine, provided that they limit such charges to a 3.5% cap on NAV for Class S shares, a 2.0% cap on NAV for Class D shares, a 2.0% cap on NAV for Class I shares and a 2.0% cap on NAV for Class F shares. Please consult your selling agent for additional information. |

Q: |

What are our expected operating expenses? |

A: |

We expect to incur operating expenses in the form of our management and incentive fees, shareholder servicing and/or distribution fees, interest expense on our borrowings and other expenses, including the fees we pay to our Administrator. See “Fees and Expenses.” |

Q: |

What are our policies related to conflicts of interests with HPS and its affiliates? |

A: |

The Adviser and its affiliates are subject to certain conflicts of interest with respect to the services HPS (in its capacity as the Adviser and the Administrator) provide for us. These conflicts arise primarily from the involvement of HPS in other activities that may conflict with our activities. You should be aware that individual conflicts will not necessarily be resolved in favor of our interest. |

| • | Conflicts of Interest Generally. co-investment order from the SEC. Subject to the limitations of the 1940 Act, the Fund may invest in loans or other securities, the proceeds of which may refinance or otherwise repay debt or securities of companies whose debt is owned by other HPS funds and accounts. |

| • | Relationship among the Fund, the Adviser and the Investment Team |

| • | Co-Investment Transactions.co-invest with certain other persons, including certain affiliated accounts managed and controlled by the Adviser. Subject to the 1940 Act and the conditions of the co-investment order issued by the SEC, the Fund may, under certain circumstances, co-invest with certain affiliated accounts in investments that are suitable for the Fund and one or more of such affiliated accounts. Even though the Fund and any such affiliated account co-invest in the same securities, conflicts of interest may still arise. If the Adviser is presented with co-investment opportunities that generally fall within the Fund’s investment objective and other Board-established criteria and those of one or more affiliated accounts advised by the Adviser, whether focused on a debt strategy or otherwise, the Adviser will allocate such opportunities among the Fund and such affiliated accounts in a manner consistent with the exemptive order and the Adviser’s allocation policies and procedures. |

| • | Competition among the Accounts Sponsored or Managed by the Adviser and Its Affiliates |

Q: |

What is the impact of being an “emerging growth company”? |

A: |

We are an “emerging growth company,” as defined by the JOBS Act. As an emerging growth company, we are eligible to take advantage of certain exemptions from various reporting and disclosure requirements that are applicable to public companies that are not emerging growth companies. For so long as we remain an emerging growth company, we will not be required to: |

| • | have an auditor attestation report on our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley Act”); |

| • | submit certain executive compensation matters to shareholder advisory votes pursuant to the “say on frequency” and “say on pay” provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the “say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010; or |

| • | disclose certain executive compensation related items, such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation. |

Q: |

Who can help answer my questions? |

A: |

If you have more questions about this offering or if you would like additional copies of this prospectus, you should contact your financial advisor or our transfer agent at HPS Corporate Lending Fund, c/o U.S. Bank Global Fund Services, 615 East Michigan Street Milwaukee, WI 53202, or at 1-888-484-1944. |

| Class S Shares |

Class F Shares |

Class D Shares |

Class I Shares |

|||||||||||||

Shareholder transaction expense ( |

||||||||||||||||

Maximum sales load (1)

|

|

% |

|

% |

|

% |

|

% | ||||||||

Maximum Early Repurchase Deduction (2)

|

% | % | % | % | ||||||||||||

Annual expenses ( (3)

|

||||||||||||||||

Base management fees (4)

|

% | % | % | % | ||||||||||||

Incentive fees (5)

|

|

% |

|

% |

|

% |

|

% | ||||||||

Shareholder servicing and/or distribution fees (6)

|

% | % | % |

|

% | |||||||||||

Interest payment on borrowed funds (7)

|

% | % | % | % | ||||||||||||

Other expenses (8)

|

% | % | % | % | ||||||||||||

Total annual expenses |

% | % | % | % |

| (1) | No upfront sales load is paid with respect to Class S shares, Class D shares, Class I shares or Class F shares; however, if you buy Class S shares, Class D shares, Class I shares or Class F shares through certain financial intermediaries, they may directly charge you transaction or other fees, including upfront placement fees or brokerage commissions, in such amount as they may determine, provided that they limit such charges to a 3.5% cap on NAV for Class S shares, a 2.0% cap on NAV for Class D shares, a 2.0% cap on NAV for Class I shares and a 2.0% cap on NAV for Class F shares. Please consult your selling agent for additional information. |

| (2) | Under our share repurchase program, to the extent we offer to repurchase shares in any particular quarter, we expect to repurchase shares pursuant to tender offers using a purchase price equal to the NAV per share as of the last calendar day of the applicable quarter, except that shares that have not been outstanding for at least one year will be subject to a fee of 2.0% of such NAV. The one-year holding period is measured as of the subscription closing date immediately following the prospective repurchase date. The Early Repurchase Deduction may be waived, at our discretion, in the case of repurchase requests arising from the death, divorce or qualified disability of the holder. The Early Repurchase Deduction will be retained by the Fund for the benefit of remaining shareholders. |

| (3) | Estimated average net assets of $3.7 billion for the first two quarters of 2023 was employed as the denominator for the expense ratio computation. Actual net assets will depend on the number of shares we actually sell, realized gains/losses, unrealized appreciation/depreciation and share repurchase activity, if any. |

| (4) |

| (5) | We may have capital gains and investment income that could result in the payment of an incentive fee. The incentive fees, if any, are divided into two parts: |

| • | The first part of the incentive fee is based on income, whereby we pay the Adviser quarterly in arrears 12.5% of our Pre-Incentive Fee Net Investment Income Returns (as defined below) for each calendar quarter subject to a 5.0% annualized hurdle rate, with a catch-up. |

| • | The second part of the incentive is based on realized capital gains, whereby we pay the Adviser at the end of each calendar year in arrears 12.5% of cumulative realized capital gains from inception through the end of such calendar year, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid incentive fee on capital gains. |

| (6) | Subject to FINRA limitations on underwriting compensation, we also pay the following shareholder servicing and/or distribution fees to the Managing Dealer and/or a participating broker: (a) for Class S shares, a shareholder servicing and/or distribution fee equal to 0.85% per annum of the aggregate NAV as of the beginning of the first calendar day of the month for the Class S shares, (b) for Class D shares, a shareholder servicing fee equal to 0.25% per annum of the aggregate NAV as of the beginning of the first calendar day of the month for the Class D shares, and (c) for Class F shares, a shareholder servicing and/or distribution fee equal to 0.50% per annum of the aggregate NAV as of the beginning of the first calendar day of the month for the Class F shares, in each case, payable monthly. No shareholder servicing or distribution fees are paid with respect to the Class I shares. The total amount that will be paid over time for other underwriting compensation depends on the average length of time for which shares remain outstanding, the term over which such amount is measured and the performance of our investments. We will cease paying the shareholder servicing and/or distribution fee on the Class S shares, Class D shares and Class F shares on the earlier to occur of the following: (i) a listing of Class I shares, (ii) our merger or consolidation with or into another entity, or the sale or other disposition of all or substantially all of our assets or (iii) the date following the completion of the primary portion of this offering on which, in the aggregate, underwriting compensation from all sources in connection with this offering, including the shareholder servicing and/or distribution fee and other underwriting compensation, is equal to 10% of the gross proceeds from our primary offering. In addition, as required by exemptive relief that allows us to offer multiple classes of shares, at the end of the month in which the Managing Dealer in conjunction with the transfer agent determines that total transaction or other fees, including upfront placement fees or brokerage commissions, and shareholder servicing and/or distribution fees paid with respect to any single share held in a shareholder’s account would exceed, in the aggregate, 10% of the gross proceeds from the sale of such share (or a lower limit as determined by the Managing Dealer or the applicable selling agent), we will cease paying the shareholder servicing and/or distribution fee on either (i) each such share that would exceed such limit or (ii) all Class S shares, Class D shares and Class F shares in such shareholder’s account. We may modify this requirement if permitted by applicable exemptive relief. At the end of such month, the applicable Class S shares, Class D shares or Class F shares in such shareholder’s account will convert into a number of Class I shares (including any fractional shares), with an equivalent aggregate NAV as such Class S, Class D shares or Class F shares. See “Plan of Distribution” and “Use of Proceeds.” The total underwriting compensation and total organization and offering expenses will not exceed 10% and 15%, respectively, of the gross proceeds from this offering. |

| (7) | We may borrow funds to make investments, including before we have fully invested the proceeds of this continuous offering. To the extent that we determine it is appropriate to borrow funds to make investments, the costs associated with such borrowing will be indirectly borne by shareholders. The figure in the table assumes that we borrow for investment purposes an amount equal to 100% of our estimated average net assets for the fiscal year ending December 31, 2023, and that the average annual cost of borrowings, including the amortization of cost associated with obtaining borrowings and unused commitment fees on the amount borrowed is 7.46%. Our ability to incur leverage depends, in large part, the amount of money we are able to raise through the sale of shares registered in this offering and the availability of financing in the market. |

| (8) | “Other expenses” include accounting, legal and auditing fees, custodian and transfer agent fees, reimbursement of expenses to our Administrator, organization and offering expenses, insurance costs and |

| fees payable to our Trustees, as discussed in “Advisory Agreement and Administration Agreement.” Other expenses represent the estimated annual other expenses of the Fund and its subsidiaries based on annualized other expenses for the first two quarters of 2023 and estimated average net assets of $3.7 billion for the first two quarters of 2023. |

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

Total cumulative expenses you would pay on a $1,000 investment assuming a reinvested 5.0% net return comprised solely of investment income: |

$ | $ | $ | $ | ||||||||||||

Total cumulative expenses you would pay on a $1,000 investment assuming a reinvested 5.0% net return comprised solely of capital gains: |

$ | $ | $ | $ | ||||||||||||

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

Total cumulative expenses you would pay on a $1,000 investment assuming a reinvested 5.0% net return comprised solely of investment income: |

$ | $ | $ | $ | ||||||||||||

Total cumulative expenses you would pay on a $1,000 investment assuming a reinvested 5.0% net return comprised solely of capital gains: |

$ | $ | $ | $ | ||||||||||||

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

Total cumulative expenses you would pay on a $1,000 investment assuming a reinvested 5.0% net return comprised solely of investment income: |

$ | $ | $ | $ | ||||||||||||

Total cumulative expenses you would pay on a $1,000 investment assuming a reinvested 5.0% net return comprised solely of capital gains: |

$ | $ | $ | $ | ||||||||||||

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

Total cumulative expenses you would pay on a $1,000 investment assuming a reinvested 5.0% net return comprised solely of investment income: |

$ | $ | $ | $ | ||||||||||||

Total cumulative expenses you would pay on a $1,000 investment assuming a reinvested 5.0% net return comprised solely of capital gains: |

$ | $ | $ | $ | ||||||||||||

Year Ended December 31, 2022 |

||||||||||||

Class I |

Class D |

Class F |

||||||||||

Per Share Data: |

||||||||||||

Net asset value, beginning of period |

$ | 25.00 | $ | 25.00 | $ | 25.00 | ||||||

Net investment income (1)

|

2.21 | 2.19 | 2.20 | |||||||||

Net unrealized and realized gain (loss) (2)

|

(1.50 | ) | (1.49 | ) | (1.51 | ) | ||||||

Net increase (decrease) in net assets resulting from operations |

|

0.71 |

|

0.70 | 0.69 | |||||||

Distributions from net investment income (3)

|

(1.83 | ) | (1.82 | ) | (1.81 | ) | ||||||

Distributions from net realized gains (3)

|

— | — | — | |||||||||

Net increase (decrease) in net assets from shareholders’ distributions |

(1.83 | ) | (1.82 | ) | (1.81 | ) | ||||||

Total increase (decrease) in net assets |

(1.12 | ) | (1.12 | ) | (1.12 | ) | ||||||

Net asset value, end of period |

$ | 23.88 | $ | 23.88 | $ | 23.88 | ||||||

Shares outstanding, end of period |

35,101,879 | |

17,538,259 |

|

92,059,512 | |||||||

Total return based on NAV (4)

|

2.93 | % | 2.89 | % | 2.85 | % | ||||||

Ratios: |

||||||||||||

Ratio of net expenses to average net assets (5)

|

3.11 | % | 3.09 | % | 3.28 | % | ||||||

Ratio of net investment income to average net assets (5)

|

9.95 | % | 9.88 | % | 9.91 | % | ||||||

Portfolio turnover rate |

6.82 | % | 6.82 | % | 6.82 | % | ||||||

Supplemental Data: |

||||||||||||

Net assets, end of period |

$ | 838,207 | $ | 418,798 | $ | 2,198,267 | ||||||

Asset coverage ratio |

247.4 | % | 247.4 | % | 247.4 | % | ||||||

| (1) | The per share data was derived by using the weighted average shares outstanding during the period. |

| (2) | The amount shown does not correspond with the aggregate amount for the period as it includes the effect of the timing of capital transactions. |

| (3) | The per share data for distributions was derived by using the actual shares outstanding at the date of the relevant transactions (please refer to “Note 9. Net Assets” to the consolidated financial statements included elsewhere in this prospectus). |

| (4) | Total return is calculated as the change in NAV per share during the period, plus distributions per share (assuming distributions are reinvested in accordance with the Fund’s distribution reinvestment plan) divided by the beginning NAV per share. Total return does not include upfront transaction fee, if any. |

| (5) | For the year ended December 31, 2022, amounts are annualized except for non-recurring expenses. For the year ended December 31, 2022, the ratio of total operating expenses to average net assets was 5.42%, 5.55% and 5.93% on Class I, Class D and Class F respectively, on an annualized basis, excluding the effect of expense support/(recoupment), distribution and shareholder servicing fees waiver, and management fee and income based incentive fee waivers by the Adviser which represented 2.30%, 2.46% and 2.66% on Class I, Class D and Class F, respectively, of average net assets. |

Assumed Return on Portfolio (Net of Expenses) (1)

|

||||||||||||||||||||

-10% |

-5% |

0% |

5% |

10% |

||||||||||||||||

Corresponding Return to Common Shareholders (2)

|

( |

)% | ( |

)% | ( |

)% | % | % | ||||||||||||

| (1) | The assumed portfolio return is required by SEC regulations and is not a prediction of, and does not represent, our projected or actual performance. Actual returns may be greater or less than those appearing in the table. Pursuant to SEC regulations, this table is calculated as of December 31, 2022. As a result, it has not been updated to take into account any changes in assets or leverage since December 31, 2022. |

| (2) | In order to compute the “Corresponding Return to Common Shareholders,” the “Assumed Return on Portfolio” is multiplied by the total value of our assets at December 31, 2022 to obtain an assumed return to us. From this amount, the interest expense (calculated by multiplying the weighted average stated interest rate of 7.16% (excluding deferred financing costs, deferred issuance costs and unused fees) by the approximately $2,344.6 million of principal debt outstanding) is subtracted to determine the return available to shareholders. The return available to shareholders is then divided by the total value of our net assets as of December 31, 2022 to determine the “Corresponding Return to Common Shareholders.” |

| • | increase or maintain in whole or in part the Fund’s voting percentage; |

| • | exercise warrants, options or convertible securities that were acquired in the original or subsequent financing; or |

| • | attempt to preserve or enhance the value of the Fund’s investment. |

| • | the higher interest rates on PIK instruments reflect the payment deferral and increased credit risk associated with these instruments, and PIK instruments generally represent a significantly higher credit risk than coupon loans; |

| • | original issue discount and PIK instruments may have unreliable valuations because the accruals require judgments about collectability of the deferred payments and the value of any associated collateral; |

| • | an election to defer PIK interest payments by adding them to the principal on such instruments increases our future investment income which increases our net assets and, as such, increases the Adviser’s future base management fees which, thus, increases the Adviser’s future income incentive fees at a compounding rate; |