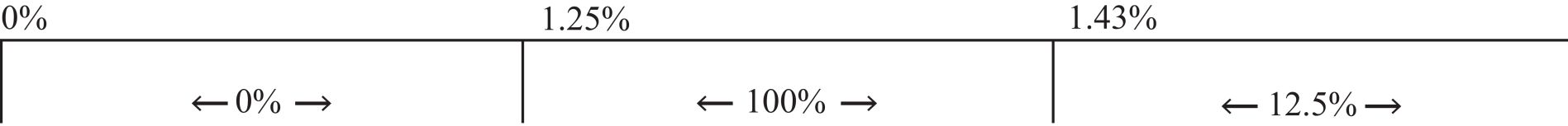

0001838126falseNYNYTotal amount of each class of senior securities outstanding at the end of the period presented.Asset coverage per unit is the ratio of the carrying value of our total assets, less all liabilities excluding indebtedness represented by senior securities in this table, to the aggregate amount of senior securities representing indebtedness. Asset coverage per unit is expressed in terms of dollar amounts per $1,000 of indebtedness and is calculated on a consolidated basis.The amount to which such class of senior security would be entitled upon our involuntary liquidation in preference to any security junior to it. The “-” in this column indicates information that the SEC expressly does not require to be disclosed for certain types of senior securities.The assumed portfolio return is required by SEC regulations and is not a prediction of, and does not represent, our projected or actual performance. Actual returns may be greater or less than those appearing in the table. Pursuant to SEC regulations, this table is calculated as of December 31, 2024. As a result, it has not been updated to take into account any changes in assets or leverage since December 31, 2024.In order to compute the “Corresponding Return to Common Shareholders,” the “Assumed Return on Portfolio” is multiplied by the total value of our assets at December 31, 2024 to obtain an assumed return to us. From this amount, the interest expense (calculated by multiplying the weighted average stated interest rate of 6.66% by the approximately $7,508.7 million of principal debt outstanding) is subtracted to determine the return available to shareholders. The return available to shareholders is then divided by the total value of our net assets as of December 31, 2024 to determine the “Corresponding Return to Common Shareholders.”Neither the Fund nor the Managing Dealer will charge upfront sales load with respect to Class S shares, Class D shares, Class I shares or Class F shares; however, if you buy Class S shares, Class D shares, Class I shares or Class F shares through certain financial intermediaries, they may directly charge you transaction or other fees, including upfront placement fees or brokerage commissions, in such amount as they may determine, provided that they limit such charges to a 3.5% cap on NAV for Class S shares, a 2.0% cap on NAV for Class D shares, a 2.0% cap on NAV for Class I shares and a 2.0% cap on NAV for Class F shares. Please consult your selling agent for additional information.Under our share repurchase program, to the extent we offer to repurchase shares in any particular quarter, we expect to repurchase shares pursuant to tender offers using a purchase price equal to the NAV per share as of the last calendar day of the applicable quarter, except that shares that have not been outstanding for at least one year will be subject to a fee of 2.0% of such NAV. The one-year holding period is measured as of the subscription closing date immediately following the prospective repurchase date. The Early Repurchase Deduction may be waived, at our discretion, in the case of repurchase requests arising from the death, divorce or qualified disability of the holder. The Early Repurchase Deduction will be retained by the Fund for the benefit of remaining shareholders.Estimated average net assets of $10.5 billion for the fiscal year ending December 31, 2025 was employed as the denominator for the expense ratio computation. Actual net assets will depend on the number of shares we actually sell, realized gains/losses, unrealized appreciation/depreciation and share repurchase activity, if any.The base management fee paid to our Adviser is calculated at an annual rate of 1.25% of the value of our net assets as of the beginning of the first calendar day of the applicable month. Subject to FINRA limitations on underwriting compensation, we pay the following shareholder servicing and/or distribution fees to the Managing Dealer and/or a participating broker: (a) for Class S shares, a shareholder servicing and/or distribution fee equal to 0.85% per annum of the aggregate NAV, (b) for Class D shares, a shareholder servicing fee equal to 0.25% per annum of the aggregate NAV, and (c) for Class F shares, a shareholder servicing and/or distribution fee equal to 0.50% per annum of the aggregate NAV, in each case payable on a monthly basis in arrears as of the first calendar day of the month. No shareholder servicing or distribution fees are paid with respect to the Class I shares. The total amount that will be paid over time for other underwriting compensation depends on the average length of time for which shares remain outstanding, the term over which such amount is measured and the performance of our investments. We will cease paying the shareholder servicing and/or distribution fee on the Class S shares, Class D shares and Class F shares on the earlier to occur of the following: (i) a listing of Class I shares, (ii) our merger or consolidation with or into another entity, or the sale or other disposition of all or substantially all of our assets or (iii) the date following the completion of the primary portion of this offering on which, in the aggregate, underwriting compensation from all sources in connection with this offering, including the shareholder servicing and/or distribution fee and other underwriting compensation, is equal to 10% of the gross proceeds from our primary offering. In addition, as required by exemptive relief that allows us to offer multiple classes of shares, at the end of the month in which the Managing Dealer in conjunction with the transfer agent determines that total transaction or other fees, including upfront placement fees or brokerage commissions, and shareholder servicing and/or distribution fees paid with respect to any single share held in a shareholder’s account would exceed, in the aggregate, 10% of the gross proceeds from the sale of such share (or a lower limit as determined by the Managing Dealer and the applicable selling agent), we will cease paying the shareholder servicing and/or distribution fee on either (i) each such share that would exceed such limit or (ii) all Class S shares, Class D shares and Class F shares in such shareholder’s account. We may modify this requirement if permitted by applicable exemptive relief. At the end of such month, the applicable Class S shares, Class D shares or Class F shares in such shareholder’s account will convert into a number of Class I shares (including any fractional shares), with an equivalent aggregate NAV as such Class S, Class D shares or Class F shares. See “Plan of Distribution” and “Use of Proceeds.” The total underwriting compensation and total organization and offering expenses will not exceed 10% and 15%, respectively, of the gross proceeds from this offering.We may have capital gains and investment income that could result in the payment of an incentive fee. The incentive fees, if any, are divided into two parts: • The first part of the incentive fee is based on income, whereby we pay the Adviser quarterly in arrears 12.5% of our Pre-Incentive Fee Net Investment Income Returns (as defined below) for each calendar quarter subject to a 5.0% annualized hurdle rate, with a catch-up. • The second part of the incentive is based on realized capital gains, whereby we pay the Adviser at the end of each calendar year in arrears 12.5% of cumulative realized capital gains from inception through the end of such calendar year, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid incentive fee on capital gains.As we cannot predict whether we will meet the necessary performance targets, we have assumed no incentive fee for this chart. We expect the incentive fees we pay to increase to the extent we earn greater income or generate capital gains through our investments in portfolio companies. If we achieved an annualized total return of 5.0% for each quarter made up entirely of net investment income, no incentive fees would be payable to the Adviser because the hurdle rate was not exceeded. If instead we achieved a total return of 5.0% in a calendar year made up of entirely realized capital gains net of all realized capital losses and unrealized capital depreciation, an incentive fee equal to 0.63% of our net assets would be payable. See “Investment Advisory Agreement and Administration Agreement” for more information concerning the incentive fees.We may borrow funds to make investments, including before we have fully invested the proceeds of this continuous offering. To the extent that we determine it is appropriate to borrow funds to make investments, the costs associated with such borrowing will be indirectly borne by shareholders. The figure in the table assumes that we borrow for investment purposes an amount equal to 100% of our estimated average net assets for the fiscal year ending December 31, 2025, and that the average annual cost of borrowings, including the amortization of cost associated with obtaining borrowings, unused commitment fees and original issue discounts on the amount borrowed is 6.94%. Our ability to incur leverage depends, in large part, the amount of money we are able to raise through the sale of shares registered in this offering and the availability of financing in the market.“Other expenses” include accounting, legal and auditing fees, custodian and transfer agent fees, reimbursement of expenses to our Administrator, organization and offering expenses, insurance costs and fees payable to our Trustees, as discussed in “Investment Advisory Agreement and Administration Agreement.” Other expenses represent the estimated annual other expenses of the Fund and its subsidiaries based on annualized other expenses for the current fiscal year ending December 31, 2025 and estimated average net assets of $10.5 billion for the fiscal year ending December 31, 2025. We have entered into the Expense Support Agreement with the Adviser. Pursuant to the Expense Support Agreement, the Adviser is obligated to advance all of our Other Operating Expenses (each, a “Required Expense Payment”) to the effect that such expenses do not exceed 1.00% (on an annualized basis) of the Fund’s NAV. Any Required Expense Payment must be paid by the Adviser to us in any combination of cash or other immediately available funds and/or offset against amounts due from us to the Adviser or its affiliates. The Adviser may elect to pay certain additional expenses on our behalf (each, a “Voluntary Expense Payment” and together with a Required Expense Payment, the “Expense Payments”), provided that no portion of the payment will be used to pay any interest expense or shareholder servicing and/or distribution fees of the Fund. Any Voluntary Expense Payment that the Adviser has committed to pay must be paid by the Adviser to us in any combination of cash or other immediately available funds no later than forty-five days after such commitment was made in writing, and/or offset against amounts due from us to the Adviser or its affiliates. The Adviser will be entitled to reimbursement of an Expense Payment from us if Available Operating Funds (as defined below under “Expense Support and Conditional Reimbursement Agreement”) exceed the cumulative distributions accrued to the Fund’s shareholders, among other conditions. See “Expense Support and Conditional Reimbursement Agreement” for additional information regarding the Expense Support Agreement. Because the Adviser’s obligation to make Voluntary Expense Payments is voluntary, the table above does not reflect the impact of any Voluntary Expense Payments from the Adviser. 0001838126 2025-04-24 2025-04-24 0001838126 ck0001838126:RisksRelatingToTheFundsBusinessAndStructureMember 2025-04-24 2025-04-24 0001838126 ck0001838126:RisksRelatingToTheFundsInvestmentsMember 2025-04-24 2025-04-24 0001838126 ck0001838126:RisksRelatingToCertainRegulatoryMattersMember 2025-04-24 2025-04-24 0001838126 ck0001838126:RisksRelatedToTheHpsblackrockTransactionMember 2025-04-24 2025-04-24 0001838126 ck0001838126:FederalIncomeTaxRisksMember 2025-04-24 2025-04-24 0001838126 ck0001838126:ClassSSharesMember 2025-04-24 2025-04-24 0001838126 ck0001838126:ClassDSharesMember 2025-04-24 2025-04-24 0001838126 ck0001838126:ClassISharesMember 2025-04-24 2025-04-24 0001838126 ck0001838126:ClassFSharesMember 2025-04-24 2025-04-24 0001838126 ck0001838126:CommonSharesMember 2025-04-24 2025-04-24 0001838126 ck0001838126:PreferredSharesMember 2025-04-24 2025-04-24 0001838126 dei:BusinessContactMember 2025-04-24 2025-04-24 0001838126 ck0001838126:investmentsincomeMember ck0001838126:ClassSSharesMember 2025-04-24 2025-04-24 0001838126 ck0001838126:CapitalGainsMember ck0001838126:ClassSSharesMember 2025-04-24 2025-04-24 0001838126 ck0001838126:investmentsincomeMember ck0001838126:ClassFSharesMember 2025-04-24 2025-04-24 0001838126 ck0001838126:CapitalGainsMember ck0001838126:ClassFSharesMember 2025-04-24 2025-04-24 0001838126 ck0001838126:investmentsincomeMember ck0001838126:ClassISharesMember 2025-04-24 2025-04-24 0001838126 ck0001838126:CapitalGainsMember ck0001838126:ClassISharesMember 2025-04-24 2025-04-24 0001838126 ck0001838126:investmentsincomeMember ck0001838126:ClassDSharesMember 2025-04-24 2025-04-24 0001838126 ck0001838126:CapitalGainsMember ck0001838126:ClassDSharesMember 2025-04-24 2025-04-24 0001838126 ck0001838126:HlendAFundingFacilityMember 2024-12-31 0001838126 ck0001838126:HlendBFundingFacilityMember 2024-12-31 0001838126 ck0001838126:November2025NotesMember 2024-12-31 0001838126 ck0001838126:November2027NotesMember 2024-12-31 0001838126 ck0001838126:HlendCFundingFacilityMember 2024-12-31 0001838126 ck0001838126:HlendDFundingFacilityMember 2024-12-31 0001838126 ck0001838126:HlendEFundingFacilityMember 2024-12-31 0001838126 ck0001838126:RevolvingCreditFacilitysMember 2024-12-31 0001838126 ck0001838126:March2026NotesMember 2024-12-31 0001838126 ck0001838126:March2028NotesMember 2024-12-31 0001838126 ck0001838126:September2028NotesMember 2024-12-31 0001838126 ck0001838126:TwoThousandAndTwentyFourCloSecuredNotesMember 2024-12-31 0001838126 ck0001838126:ShortTermBorrowingsMember 2024-12-31 0001838126 ck0001838126:September2027NotesMember 2024-12-31 0001838126 ck0001838126:January2029NotesMember 2024-12-31 0001838126 ck0001838126:September2029NotesMember 2024-12-31 0001838126 ck0001838126:TwoThousandAndTwentyThreeCloSecuredNotesMember 2024-12-31 0001838126 ck0001838126:HlendAFundingFacilityMember 2023-12-31 0001838126 ck0001838126:HlendBFundingFacilityMember 2023-12-31 0001838126 ck0001838126:RevolvingCreditFacilitysMember 2023-12-31 0001838126 ck0001838126:November2025NotesMember 2023-12-31 0001838126 ck0001838126:HlendCFundingFacilityMember 2023-12-31 0001838126 ck0001838126:HlendDFundingFacilityMember 2023-12-31 0001838126 ck0001838126:March2026NotesMember 2023-12-31 0001838126 ck0001838126:March2028NotesMember 2023-12-31 0001838126 ck0001838126:September2028NotesMember 2023-12-31 0001838126 ck0001838126:ShortTermBorrowingsMember 2023-12-31 0001838126 ck0001838126:September2027NotesMember 2023-12-31 0001838126 ck0001838126:TwoThousandAndTwentyThreeCloSecuredNotesMember 2023-12-31 0001838126 ck0001838126:November2027NotesMember 2023-12-31 0001838126 ck0001838126:HlendAFundingFacilityMember 2022-12-31 0001838126 ck0001838126:HlendBFundingFacilityMember 2022-12-31 0001838126 ck0001838126:RevolvingCreditFacilitysMember 2022-12-31 0001838126 ck0001838126:November2025NotesMember 2022-12-31 0001838126 ck0001838126:November2027NotesMember 2022-12-31 0001838126 ck0001838126:ShortTermBorrowingsMember 2022-12-31 xbrli:pure xbrli:shares iso4217:USD iso4217:USD xbrli:shares

As filed with the U.S. Securities and Exchange Commission on April 24, 2025

SECURITIES AND EXCHANGE COMMISSION

|

|

|

|

|

|

|

THE SECURITIES ACT OF 1933 |

|

☒ |

|

|

Pre-Effective Amendment No. |

|

☐ |

|

|

Post-Effective Amendment No. 1

|

|

☒ |

HPS Corporate Lending Fund

(Exact name of registrant as specified in charter)

40 West 57th

Street,

33rd

Floor (Address and telephone number, including area code, of principal executive offices)

40 West 57th

Street,

33rd

Floor (Name and address of agent for service)

1095 Avenue of the Americas

Approximate Date of Commencement of Proposed Public Offering

:

As soon as practicable after the effective date of this Registration Statement.

| |

☐ |

Check box if the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans. |

| |

☒ |

Check box if any securities being registered on this Form will be offered on a delayed or continuous basis in reliance on Rule 415 under the Securities Act of 1933 (“Securities Act”), other than securities offered in connection with a dividend reinvestment plan. |

| |

☐ |

Check box if this Form is a registration statement pursuant to General Instruction A.2 or a post-effective amendment thereto. |

| |

☐ |

Check box if this Form is a registration statement pursuant to General Instruction B or a post-effective amendment thereto that will become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act. |

| |

☐ |

Check box if this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction B to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act. |

It is proposed that this filing will become effective (check appropriate box):

| |

☐ |

when declared effective pursuant to Section 8(c) of the Securities Act. |

| |

☒ |

immediately upon filing pursuant to paragraph (b) of Rule 486. |

| |

☐ |

on (date) pursuant to paragraph (b) of Rule 486. |

| |

☐ |

60 days after filing pursuant to paragraph (a) of Rule 486. |

| |

☐ |

on (date) pursuant to paragraph (a) of Rule 486. |

If appropriate, check the following box:

| |

☐ |

This [post-effective] amendment designates a new effective date for a previously filed [post-effective amendment] [registration statement]. |

| |

☐ |

This Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is: |

| |

☐ |

This Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is: |

| |

☐ |

This Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is: |

| |

☐ |

This Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is: |

Check each box that appropriately characterizes the Registrant:

| |

☐ |

Registered Closed-End Fund (closed-end company that is registered under the Investment Company Act of 1940 (“1940 Act”)). |

| |

☒ |

Business Development Company (closed-end company that intends or has elected to be regulated as a business development company under the 1940 Act). |

| |

☐ |

Interval Fund (Registered Closed-End Fund or a Business Development Company that makes periodic repurchase offers under Rule 23c-3 under the 1940 Act). |

| |

☐ |

A.2 Qualified (qualified to register securities pursuant to General Instruction A.2 of this Form). |

| |

☐ |

Well-Known Seasoned Issuer (as defined by Rule 405 under the Securities Act). |

| |

☐ |

Emerging Growth Company (as defined by Rule 12b-2 under the Securities Exchange Act of 1934 (“Exchange Act”)). |

| |

☐ |

If an Emerging Growth Company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. |

| |

☐ |

New Registrant (registered or regulated under the 1940 Act for less than 12 calendar months preceding this filing). |

HPS Corporate Lending Fund

Class S, Class D, Class I and Class F Shares

Maximum Offering of $15,000,000,000

HPS Corporate Lending Fund is a Delaware statutory trust that seeks to invest primarily in newly originated senior secured debt and other securities of private U.S. companies within the upper middle market. Our investment objective is to generate attractive risk-adjusted returns, predominately in the form of current income, with select investments exhibiting the ability to capture long-term capital appreciation. Throughout this prospectus, we refer to HPS Corporate Lending Fund as the “Fund,” “HLEND,” “we,” “us” or “our.”

We are a

non-diversified,

closed-end

management investment company that has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). We are externally managed by our adviser, HPS Advisors, LLC (the “Adviser”), a wholly-owned subsidiary of HPS Investment Partners, LLC (“HPS”). We have elected to be treated for federal income tax purposes, and intend to qualify annually, as a regulated investment company under the Internal Revenue Code of 1986, as amended.

We are offering on a continuous basis up to $15,000,000,000 of our common shares of beneficial interest (the “Common Shares”). We are offering to sell any combination of four classes of Common Shares, Class S shares, Class D shares, Class I shares and Class F shares, with a dollar value up to the maximum offering amount. The share classes have different ongoing shareholder servicing and/or distribution fees. The purchase price per share for each class of Common Shares will equal our net asset value (“NAV”) per share, as of the effective date of the monthly share purchase date. This is a “best efforts” offering, which means that HPS Securities, LLC, the managing dealer (the “Managing Dealer”) for this offering, will use its best efforts to sell shares, but is not obligated to purchase or sell any specific amount of shares in this offering.

The Fund has been granted exemptive relief by the SEC to offer multiple classes of our Common Shares.

Investing in our Common Shares involves a high degree of risk. See “

Risk Factors” beginning on page 33 of this prospectus. Also consider the following:

| |

|

|

We have limited prior operating history and there is no assurance that we will achieve our investment objective. |

| |

|

|

You should not expect to be able to sell your shares regardless of how we perform. |

| |

|

|

You should consider that you may not have access to the money you invest for an extended period of time. |

| |

|

|

We do not intend to list our shares on any securities exchange, and we do not expect a secondary market in our shares to develop prior to any listing. |

| |

|

|

Because you may be unable to sell your shares, you will be unable to reduce your exposure in any market downturn. |

| |

|

|

We have implemented a share repurchase program, but only a limited number of shares will be eligible for repurchase and repurchases will be subject to available liquidity and other significant restrictions. |

| |

|

|

An investment in our Common Shares is not suitable for you if you need access to the money you invest. See “Suitability Standards” and “Share Repurchase Program.” |

| |

|

|

You will bear substantial fees and expenses in connection with your investment. See “Fees and Expenses.” |

| |

|

|

We cannot guarantee that we will make distributions, and if we do, we may fund such distributions from sources other than cash flow from operations, including, without limitation, the sale of assets, borrowings, proceeds from this offering or return of capital, and we have no limits on the amounts we may pay from such sources. |

| |

|

|

Distributions may also be funded in significant part, directly or indirectly, from temporary waivers or expense reimbursements borne by the Adviser or its affiliates, that may be subject to reimbursement to the Adviser or its affiliates. The repayment of any amounts owed to the Adviser or its affiliates will reduce future distributions to which you would otherwise be entitled. |

| |

|

|

We use and continue to expect to use leverage, which will magnify the potential for loss on amounts invested and may increase the risk of investing in us. The risks of investment in a highly leverage fund include volatility and possible distribution restrictions. |

| |

|

|

We invest primarily in securities that are rated below investment grade by rating agencies or that would be rated below investment grade if they were rated. Below investment grade securities, which are often referred to as “junk,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may also be illiquid and difficult to value. |

Neither the Securities and Exchange Commission nor any state securities regulator has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. Securities regulators have also not passed upon whether this offering can be sold in compliance with existing or future suitability or conduct standards including the ‘Regulation Best Interest’ standard to any or all purchasers.

The use of forecasts in this offering is prohibited. Any oral or written predictions about the amount or certainty of any cash benefits or tax consequences that may result from an investment in our Common Shares is prohibited. No one is authorized to make any statements about this offering different from those that appear in this prospectus.

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Proceeds to Us, Before Expenses (2)

|

|

|

|

$ |

15,000,000,000 |

|

|

$ |

15,000,000,000 |

|

Class S Shares, per Share |

|

$ |

25.51 |

|

|

$ |

3,750,000,000 |

|

Class D Shares, per Share |

|

$ |

25.51 |

|

|

$ |

3,750,000,000 |

|

Class I Shares, per Share |

|

$ |

25.51 |

|

|

$ |

3,750,000,000 |

|

Class F Shares, per Share |

|

$ |

25.51 |

|

|

$ |

3,750,000,000 |

|

| (1) |

Class D shares, Class I shares and Class F shares were initially offered at $25.00 per share and Class S shares were initially offered at $25.11 per share, and are currently being offered on a monthly basis at a price per share equal to the NAV per share for such class. The table reflects the NAV per share of each class as of February 28, 2025. |

| (2) |

Neither the Fund nor the Managing Dealer will charge upfront sales load with respect to Class S shares, Class D shares, Class I shares or Class F shares; however, if you buy Class S shares, Class D shares, Class I shares or Class F shares through certain financial intermediaries, they may directly charge you transaction or other fees, including upfront placement fees or brokerage commissions, in such amount as they may determine, provided that they limit such charges to a 3.5% cap on NAV for Class S shares, a 2.0% cap on NAV for Class D shares, a 2.0% cap on NAV for Class I shares and a 2.0% cap on NAV for Class F shares. We also pay the following shareholder servicing and/or distribution fees to the Managing Dealer and/or a participating broker, subject to Financial Industry Regulatory Authority, Inc. (“FINRA”) limitations on underwriting compensation: (a) for Class S shares, a shareholder servicing and/or distribution fee equal to 0.85% per annum of the aggregate NAV, (b) for Class D shares, a shareholder servicing fee equal to 0.25% per annum of the aggregate NAV, and (c) for Class F shares, a shareholder servicing and/or distribution fee equal to 0.50% per annum of the aggregate NAV, in each case payable on a monthly basis in arrears as of the first calendar day of the month. No shareholder servicing or distribution fees are paid with respect to the Class I shares. The total amount that will be paid over time for other underwriting compensation depends on the average length of time for which shares remain outstanding, the term over which such amount is measured and the performance of our investments. We also pay or reimburse certain organization and offering expenses, including, subject to FINRA limitations on underwriting compensation, certain wholesaling expenses. See “Plan of Distribution” and “Use of Proceeds.” The total underwriting compensation and total organization and offering expenses will not exceed 10% and 15%, respectively, of the gross proceeds from this offering. Proceeds are calculated before deducting shareholder servicing or distribution fees or organization and offering expenses payable by us, which are paid over time. |

| (3) |

The table assumes that all shares are sold in the primary offering, with 1/4 of the gross offering proceeds from the sale of Class S shares, 1/4 from the sale of Class D shares, 1/4 from the sale of Class I shares and 1/4 from the sale of Class F shares. The number of shares of each class sold and the relative proportions in which the classes of shares are sold are uncertain and may differ significantly from this assumption. |

This prospectus contains important information you should know before investing in the Common Shares. Please read this prospectus before investing and keep it for future reference. We also file periodic and current reports, proxy statements and other information about us with the U.S. Securities and Exchange Commission (the “SEC”). This information is available free of charge by contacting us at 40 West 57

th

Street, 33

rd

Floor, New York, NY 10019, calling us at

or visiting our corporate website located at

. Information on our website is not incorporated into or a part of this prospectus. The SEC also maintains a website at

that contains this information.

The date of this prospectus is April 24, 2025

Common Shares offered through this prospectus are suitable only as a long-term investment for persons of adequate financial means such that they do not have a need for liquidity in this investment. We have established financial suitability standards for initial shareholders in this offering which require that a purchaser of shares have either:

| |

• |

|

a gross annual income of at least $70,000 and a net worth of at least $70,000, or |

| |

• |

|

a net worth of at least $250,000. |

For purposes of determining the suitability of an investor, net worth in all cases should be calculated excluding the value of an investor’s home, home furnishings and automobiles. In the case of sales to fiduciary accounts, these minimum standards must be met by the beneficiary, the fiduciary account or the donor or grantor who directly or indirectly supplies the funds to purchase the shares if the donor or grantor is the fiduciary.

In addition, we will not sell shares to investors in the states named below unless they meet special suitability standards set forth below:

—In addition to the suitability standards set forth above, an investment in us will only be sold to Alabama residents that have a liquid net worth of at least 10 times their investment in us and our affiliates.

—California residents may not invest more than 10% of their liquid net worth in us and must have either (a) a liquid net worth of $350,000 and annual gross income of $65,000 or (b) a liquid net worth of $500,000.

—Purchasers residing in Idaho must have either (a) a liquid net worth of $85,000 and annual gross income of $85,000 or (b) a liquid net worth of $300,000. Additionally, the total investment in us shall not exceed 10% of their liquid net worth.

—Iowa investors must (i) have either (a) an annual gross income of at least $100,000 and a net worth of at least $100,000, or (b) a net worth of at least $350,000 (net worth should be determined exclusive of home, auto and home furnishings); and (ii) limit their aggregate investment in this offering and in the securities of other

non-traded

BDCs to 10% of such investor’s liquid net worth (liquid net worth should be determined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities).

—It is recommended by the Office of the Kansas Securities Commissioner that Kansas investors limit their aggregate investment in our securities and other similar investments to not more than 10% of their liquid net worth. Liquid net worth shall be defined as that portion of the purchaser’s total net worth that is comprised of cash, cash equivalents, and readily marketable securities, as determined in conformity with GAAP.

—A Kentucky investor may not invest more than 10% of its liquid net worth in us or our affiliates. “Liquid net worth” is defined as that portion of net worth that is comprised of cash, cash equivalents and readily marketable securities.

—The Maine Office of Securities recommends that an investor’s aggregate investment in this offering and similar direct participation investments not exceed 10% of the investor’s liquid net worth. For this purpose, “liquid net worth” is defined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities.

—In addition to the suitability standards set forth above, Massachusetts residents may not invest more than 10% of their liquid net worth in us,

non-traded

real estate investment trusts, and in other illiquid direct participation programs.

—In addition to the suitability standards set forth above, no more than ten percent (10%) of any one (1) Missouri investor’s liquid net worth shall be invested in the securities being registered in this offering.

—In addition to the suitability standards set forth above, Nebraska investors must limit their aggregate investment in this offering and the securities of other business development companies to 10% of such investor’s net worth. Investors who are accredited investors as defined in Regulation D under the Securities Act of 1933, as amended (the “Securities Act”), are not subject to the foregoing investment concentration limit.

—New Jersey investors must have either (a) a minimum liquid net worth of at least $100,000 and a minimum annual gross income of not less than $85,000, or (b) a minimum liquid net worth of $350,000. For these purposes, “liquid net worth” is defined as that portion of net worth (total assets exclusive of home, home furnishings, and automobiles, minus total liability) that consists of cash, cash equivalents and readily marketable securities. In addition, a New Jersey investor’s investment in us, our affiliates, and other

non-publicly

traded direct investment programs (including real estate investment trusts, business development companies, oil and gas programs, equipment leasing programs and commodity pools, but excluding unregistered, federally and state exempt private offerings) may not exceed ten percent (10%) of his or her liquid net worth.

—In addition to the general suitability standards listed above, a New Mexico investor may not invest, and we may not accept from an investor more than ten percent (10%) of that investor’s liquid net worth in shares of us, our affiliates and in other

non-traded

business development companies. Liquid net worth is defined as that portion of net worth which consists of cash, cash equivalents and readily marketable securities.

—Purchasers residing in North Dakota must have a net worth of at least ten times their investment in us.

—It is unsuitable for Ohio residents to invest more than 10% of their liquid net worth in the issuer, affiliates of the issuer and in any

other non-traded BDC.

“Liquid net worth” is defined as that portion of net worth (total assets exclusive of primary residence, home furnishings and automobiles, minus total liabilities) comprised of cash, cash equivalents and readily marketable securities. This condition does not apply, directly or indirectly, to federally covered securities.

—Purchasers residing in Oklahoma may not invest more than 10% of their liquid net worth in us.

In addition to the suitability standards set forth above, Oregon investors may not invest more than 10% of their liquid net worth in us and our affiliates. Liquid net worth is defined as net worth excluding the value of the investor’s home, home furnishings and automobile.

Purchasers residing in Pennsylvania may not invest more than 10% of their liquid net worth in us.

Purchasers residing in Puerto Rico may not invest more than 10% of their liquid net worth in us, our affiliates and other

non-traded

business development companies. For these purposes, “liquid net worth” is defined as that portion of net worth (total assets exclusive of primary residence, home furnishings and automobiles minus total liabilities) consisting of cash, cash equivalents and readily marketable securities.

—Purchasers residing in Tennessee must have a liquid net worth of at least ten times their investment in us.

—Accredited investors in Vermont, as defined in 17 C.F.R. §230.501, may invest freely in this offering. In addition to the suitability standards described above,

non-accredited

Vermont investors may not purchase an amount in this offering that exceeds 10% of the investor’s liquid net worth. For these purposes, “liquid net worth” is defined as an investor’s total assets (not including home, home furnishings or automobiles) minus total liabilities.

You should purchase these securities only if you can afford the complete loss of your investment. The Adviser, those selling shares on our behalf and participating brokers and registered investment advisers recommending the purchase of shares in this offering are required to make every reasonable effort to determine

that the purchase of shares in this offering is a suitable and appropriate investment for each investor based on information provided by the investor regarding the investor’s financial situation and investment objectives and must maintain records for at least six years after the information is used to determine that an investment in our shares is suitable and appropriate for each investor. In making this determination, the participating broker, registered investment adviser, authorized representative or other person selling shares will, based on a review of the information provided by the investor, consider whether the investor:

| |

• |

|

meets the minimum income and net worth standards established in the investor’s state; |

| |

• |

|

can reasonably benefit from an investment in our Common Shares based on the investor’s overall investment objectives and portfolio structure; |

| |

• |

|

is able to bear the economic risk of the investment based on the investor’s overall financial situation; and |

| |

• |

|

has an apparent understanding of the following: |

| |

• |

|

the fundamental risks of the investment; |

| |

• |

|

the risk that the investor may lose its entire investment; |

| |

• |

|

the lack of liquidity of our shares; |

| |

• |

|

the background and qualification of our Adviser; and |

| |

• |

|

the tax consequences of the investment. |

In addition to investors who meet the minimum income and net worth requirements set forth above, our shares may be sold to financial institutions that qualify as “institutional investors” under the state securities laws of the state in which they reside. “Institutional investor” is generally defined to include banks, insurance companies, investment companies as defined in the 1940 Act, pension or profit sharing trusts and certain other financial institutions. A financial institution that desires to purchase shares will be required to confirm that it is an “institutional investor” under applicable state securities laws.

In addition to the suitability standards established herein, (i) a participating broker may impose additional suitability requirements and investment concentration limits to which an investor could be subject and (ii) various states may impose additional suitability standards, investment amount limits and alternative investment limitations.

Broker-dealers must comply with Regulation Best Interest, which, among other requirements, enhances the existing standard of conduct for broker-dealers and establishes a “best interest” obligation for broker-dealers and their associated persons when making recommendations of any securities transaction or investment strategy involving securities to a retail customer. The obligations of Regulation Best Interest are in addition to, and may be more restrictive than, the suitability requirements listed above. Certain states, including Massachusetts, have adopted or may adopt state-level standards that seek to further enhance the broker-dealer standard of conduct to a fiduciary standard for all broker-dealer recommendations made to retail customers in their states. In comparison to the standards of Regulation Best Interest, the Massachusetts fiduciary standard, for example, requires broker-dealers to adhere to the duties of utmost care and loyalty to customers. The Massachusetts standard requires a broker-dealer to make recommendations without regard to the financial or any other interest of any party other than the retail customer, and that broker-dealers must make all reasonably practicable efforts to avoid conflicts of interest, eliminate conflicts that cannot reasonably be avoided, and mitigate conflicts that cannot reasonably be avoided or eliminated. When making such a recommendation to a retail customer, a broker-dealer must, among other things, act in the best interest of the retail customer at the time a recommendation is made, without placing its interests ahead of its retail customer’s interests. A broker-dealer may satisfy the best interest standard imposed by Regulation Best Interest by meeting disclosure, care, conflict of interest and compliance obligations. Regulation Best Interest and state fiduciary standards of care also require registered investment advisers and registered broker-dealers to provide a brief summary to retail investors. This relationship summary, referred to as

Form CRS, is not a prospectus. Regulation Best Interest imposes a duty of care for broker-dealers to evaluate reasonably available alternatives in the best interests of their clients. There are likely alternatives to us that are reasonably available to you, through your broker or otherwise, and those alternatives may be less costly or have a lower investment risk. Among other alternatives, listed BDCs may be reasonable alternatives to an investment in our Common Shares, and may feature characteristics like lower cost, less complexity, and lesser or different risks. Investments in listed securities also often involve nominal or zero commissions at the time of initial purchase. Investors should refer to this prospectus for detailed information about this offering before deciding to purchase Common Shares. Currently, there is no administrative or case law interpreting Regulation Best Interest and the full scope of its applicability on brokers participating in our offering cannot be determined at this time.

Please carefully read the information in this prospectus and any accompanying prospectus supplements, which we refer to collectively as the “prospectus.” You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. This prospectus may only be used where it is legal to sell these securities. You should not assume that the information contained in this prospectus is accurate as of any date later than the date hereof or such other dates as are stated herein or as of the respective dates of any documents or other information incorporated herein by reference.

We disclose the NAV per share of each class of our Common Shares for each month when available on our website at

. Information contained on our website is not incorporated by reference into this prospectus, and you should not consider that information to be part of this prospectus.

The words “we,” “us,” “our” and the “Fund” refer to HPS Corporate Lending Fund, together with its consolidated subsidiaries.

Unless otherwise noted, numerical information relating to HPS is approximate as of December 31, 2024.

Citations included herein to industry sources are used only to demonstrate third-party support for certain statements made herein to which such citations relate. Information included in such industry sources that do not relate to supporting the related statements made herein are not part of this prospectus and should not be relied upon.

MULTI-CLASS EXEMPTIVE RELIEF

This prospectus relates to our Common Shares of Class S, Class D, Class I and Class F. We have been granted exemptive relief by the SEC to offer multiple classes of Common Shares.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements about our business, including, in particular, statements about our plans, strategies and objectives. You can generally identify forward-looking statements by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue” or other similar words. These statements include our plans and objectives for future operations, including plans and objectives relating to future growth and availability of funds, and are based on current expectations that involve numerous risks and uncertainties. Assumptions relating to these statements involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to accurately predict and many of which are beyond our control. Although we believe the assumptions underlying the forward-looking statements, and the forward-looking statements themselves, are reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurance that these forward-looking statements will prove to be accurate and our actual results, performance and achievements may be materially different from that expressed or implied by these forward-looking statements. In light of the significant uncertainties inherent in these forward looking statements, the inclusion of this information should not be regarded as a representation by us or any other person that our objectives and plans, which we consider to be reasonable, will be achieved.

You should carefully review the “Risk Factors” section of this prospectus for a discussion of the risks and uncertainties that we believe are material to our business, operating results, prospects and financial condition. Except as otherwise required by federal securities laws, we do not undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

|

|

|

|

|

|

|

|

i |

|

|

|

|

v |

|

|

|

|

v |

|

|

|

|

v |

|

|

|

|

1 |

|

|

|

|

26 |

|

|

|

|

30 |

|

|

|

|

33 |

|

|

|

|

84 |

|

|

|

|

87 |

|

|

|

|

115 |

|

|

|

|

129 |

|

|

|

|

131 |

|

|

|

|

171 |

|

|

|

|

179 |

|

|

|

|

182 |

|

|

|

|

195 |

|

|

|

|

205 |

|

|

|

|

207 |

|

|

|

|

209 |

|

|

|

|

222 |

|

|

|

|

224 |

|

|

|

|

229 |

|

|

|

|

232 |

|

|

|

|

235 |

|

|

|

|

237 |

|

|

|

|

241 |

|

|

|

|

250 |

|

|

|

|

252 |

|

|

|

|

252 |

|

|

|

|

252 |

|

|

|

|

252 |

|

|

|

|

253 |

|

|

|

|

254 |

|

|

|

|

262 |

|

|

|

|

A-1 |

|

This prospectus summary highlights certain information contained elsewhere in this prospectus and contains a summary of material information that a prospective investor should know before investing in our Common Shares. This is only a summary and it may not contain all of the information that is important to you. Before deciding to invest in this offering, you should carefully read this entire prospectus, including the “Risk Factors” section.

|

What is HPS Corporate Lending Fund (“HLEND”)? |

|

HLEND (or the Fund) is a fund externally managed by HPS Advisors, LLC (the “Adviser”), a wholly-owned subsidiary of HPS Investment Partners, LLC (“HPS”), that seeks to invest primarily in newly originated senior secured debt and other securities of private U.S. companies within the upper middle market. We are a Delaware statutory trust and a non-diversified, closed-end management investment company that has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). We also have elected to be treated as a regulated investment company (“RIC”) under the Internal Revenue Code of 1986, as amended (the “Code”). |

|

Who are the Adviser and HPS Investment Partners, LLC? |

|

As of June 30, 2023, HPS Advisors, LLC serves as our investment adviser and prior to that date, HPS served as our investment adviser. The Adviser is a wholly-owned subsidiary of HPS and has access to the same resources and investment personnel for the management of the Fund that HPS utilizes for the management of other funds and accounts. These resources and personnel enable our Adviser and Administrator (as defined below) to fulfill their obligations under the second amended and restated investment advisory agreement between the Fund and the Adviser (as amended and/or restated from time to time, the “Investment Advisory Agreement”) and the third amended and restated administration agreement between the Fund and the Administrator (as amended and/or restated from time to time, the “Administration Agreement”). HPS is a leading global credit-focused alternative investment firm with $149 billion of assets under management as of December 31, 2024. HPS invests primarily in credit and manages various strategies across the capital structure, including privately negotiated senior debt; privately negotiated junior capital solutions in debt, preferred equity and common equity formats; liquid credit, including syndicated leveraged loans, collateralized loan obligations and high yield bonds; asset-based finance and real estate. HPS has approximately 250 investment professionals and more than 770 total employees, working from fourteen 1 offices globally, as of December 31, 2024. HPS was established in 2007 as a unit of Highbridge Capital Management, LLC (“HCM”), a subsidiary of J.P. Morgan Asset Management (“JPMAM”). On March 31, 2016, the senior executives of HPS acquired HPS and its subsidiaries from JPMAM and HCM (the “Transaction”). Following the Transaction, JPMAM retained a passive minority investment in HPS, which was subsequently redeemed in April 2022. In June 2018, affiliates of Dyal Capital Partners made a passive minority investment in HPS. In February 2022, an affiliate of The Guardian Life Insurance Company of America made a passive minority investment in HPS, which was subsequently increased in August 2024. |

HPS is a leading provider of credit solutions to middle and upper middle market companies. Since its inception in 2007, HPS has committed approximately $170 billion in privately originated transactions across

|

1 |

Excludes certain smaller, regional offices. |

more than 890 investments.

2

Our objective is to bring HPS’s leading credit investment platform to the

non-exchange

traded BDC industry.

On December 3, 2024, HPS and BlackRock Inc. (“BlackRock”) entered into an agreement for BlackRock to acquire the business and assets of HPS with 100% of consideration paid in BlackRock equity (the “HPS/BlackRock Transaction”). The HPS/BlackRock Transaction is expected to close

in mid-2025 subject

to receipt of certain consents from investors in HPS funds and accounts, regulatory approvals and satisfaction of other customary closing conditions. The HPS/BlackRock Transaction is expected to bring together BlackRock’s corporate and asset owner relationships with HPS’s diversified origination and capital flexibility, and create an integrated private credit franchise with approximately $220 billion in client assets. If the HPS/BlackRock Transaction occurs, BlackRock and HPS will form a new private financing solutions business unit led by Scott Kapnick, Scot French, and Michael Patterson. This combined platform is expected to have broad capabilities across senior and junior credit solutions, asset-based finance, real estate, private placements, and CLOs. As part of the HPS/BlackRock Transaction, Scott Kapnick, Scot French, and Michael Patterson will join BlackRock’s Global Executive Committee and Scott Kapnick will be an observer to the BlackRock Board of Directors. There can be no assurances that the HPS/BlackRock Transaction will take place, or if it does, what the impact will be on HPS or the Fund.

|

What is your investment objective? |

|

Our investment objective is to generate attractive risk-adjusted returns, predominately in the form of current income, with select investments exhibiting the ability to capture long-term capital appreciation. |

|

What is your investment strategy? |

|

Our investment strategy focuses primarily on newly originated, privately negotiated senior credit investments in high-quality, established upper middle market companies and, in select situations, companies in special situations. We use the term “upper middle market companies” generally to mean companies with earnings before interest expense, income tax expense, depreciation and amortization (“EBITDA”) of $75 million to $1 billion annually or $250 million to $5 billion in revenue annually, at the time of investment. We have and may continue to invest in smaller or larger companies if an opportunity presents attractive investment characteristics and risk-adjusted returns. While our investment strategy primarily focuses on companies in the United States, we also intend to leverage HPS’s global presence to invest in companies in Europe, Australia and other locations outside the U.S., subject to compliance with BDC requirements to invest at least 70% of assets in “eligible portfolio companies.” In addition to corporate level obligations, our investments in these companies may also opportunistically include private asset-based financings such as equipment financings, financings against mission-critical corporate assets and mortgage loans. We may also selectively make investments that represent equity in portfolios of loans, receivables or other debt instruments. We may also participate in programmatic investments in partnership with one or more unaffiliated banks or other financial institutions, where our partner assumes senior exposure to each investment, and we participate in the junior exposure. |

Our investment strategy also includes a smaller allocation to more liquid credit investments such as

non-investment

grade broadly syndicated loans, leveraged loans, secured and unsecured corporate bonds, and securitized credit. We intend to use these investments to maintain liquidity for our share repurchase

|

2 |

As of December 31, 2024. Based on the total face value committed to private credit investments that are part of the Strategic Investment Partners strategy, Special Situations Opportunities strategy (private special situations investments), Specialty Direct Lending strategy, Core Senior Lending strategy, and any additional private credit investments made by one or more business development companies, private credit CLOs, separately managed funds or accounts, or private credit-focused joint ventures, excluding investments that are solely part of the High Grade Corporate-Focused, High Grade Asset-Based, Real Estate, Asset Value, or Sustainability & Energy Transition strategies. |

program and manage cash before investing subscription proceeds into originated loans, while also seeking attractive investment returns. We may also invest in publicly traded securities of larger corporate issuers on an opportunistic basis when market conditions create compelling potential return opportunities, subject to compliance with BDC requirements to invest at least 70% of assets in “eligible portfolio companies.”

|

What types of investments do you make? |

|

Under normal circumstances, we invest at least 80% of our total assets (net assets plus borrowings for investment purposes) in credit and credit-related instruments issued by corporate issuers (including loans, notes, bonds and other corporate debt securities). |

Our investments in newly originated secured debt have taken and may continue to take the form of loans, notes, bonds, other corporate debt securities, assignments, participations, total return swaps and other derivatives. We seek to invest primarily in first lien senior secured debt and unitranche loans but may also invest in second lien and subordinated debt. A portion of the Fund’s investments may also be composed of “covenant-lite loans,” although such loans are not expected to comprise a significant portion of the Fund’s portfolio. We also have the ability to acquire investments through secondary transactions, including through loan portfolios, receivables, contractual obligations to purchase subsequently originated loans and other debt instruments. Although not expected to be a primary component of our investment strategy, we may also make certain opportunistic investments in instruments other than secured debt with a view to enhancing returns, such as mezzanine debt,

(“PIK”) notes, convertible debt and other unsecured debt instruments, structured debt that is not secured by financial or other assets,

financings and equity in loan portfolios or portfolios of receivables (“Opportunistic Investments”), in each case taking into account availability of leverage for such investments and our target risk/return profile. We may, to a limited extent, invest in junior debt (whether secured or unsecured), including mezzanine loans, as part of our investment strategy and upon approval of each such investment by our portfolio management team. We may also invest in preferred equity, or our debt investments may be accompanied by equity-related securities (such as options or warrants) and/or select common equity investments. While we expect our assets to be primarily directly originated, we may also invest in structured products or broadly syndicated transactions where HPS and/or its affiliates seek an anchor-like or otherwise influential role in certain traded instruments as part of our liquid portfolio.

Our liquid credit instruments have included and may continue to include senior secured loans, senior secured bonds, high yield bonds and structured credit instruments.

The loans within the portfolio are typically floating rate instruments that often pay current income on a quarterly basis, and we look to generate return from a combination of ongoing interest income, original issue discount, closing payments, commitment fees, prepayments and related fees. Our investments generally have stated terms of three to seven years, and the expected average life of our investments is generally two to three years. However, there is no limit to the maturity or duration of any investment that we may hold in our portfolio. We expect most of our debt investments to be unrated. When rated by a nationally recognized statistical ratings organization, our investments would generally carry a rating below investment grade (rated lower than “Baa3” by Moody’s Investor Service, Inc. or lower than

“BBB-”

by Standard & Poor’s Rating Services). Below investment grade securities, which are often referred to as “junk,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may also be illiquid and difficult to value.

We have, and may in the future, enter into interest rate, foreign exchange, and/or other derivative arrangements to hedge against interest rate, currency, and/or other credit related risks through the use of futures, swaps, options and forward contracts. These hedging activities are subject to the applicable legal and regulatory compliance requirements; however, there can be no assurance any hedging strategy employed will be successful. We have and may also seek to borrow capital in local currency as a means of hedging our

non-U.S.

dollar denominated investments.

Our investments are subject to a number of risks. See “Investment Objective and Strategies” and “Risk Factors.”

|

What is an originated loan? |

|

An originated loan is a loan where we lend directly to the borrower and hold the loan generally on our own or in a small group with funds and accounts advised by HPS and/or its affiliates, and/or third-party investors. This is distinct from a syndicated loan, which is generally originated by a bank and then syndicated, or sold, in several pieces to other investors. Originated loans are generally held until maturity or until they are refinanced by the borrower. Syndicated loans often have liquid markets and can be traded by investors. |

|

Why do you invest in liquid credit investments in addition to originated loans? |

|

The allocation to liquid credit investments within the Fund’s portfolio is expected to (i) provide the Fund with sufficient liquidity in order to meet the Fund’s share repurchase requirements, and (ii) allow the Fund to seek attractive investment returns prior to investing subscription proceeds into newly originated loans. |

|

What potential competitive strengths does HPS offer? |

|

HPS is a leading global, credit-focused alternative investment firm that seeks to provide creative capital solutions and generate attractive risk-adjusted returns for its clients. The scale and breadth of HPS’s platform offers the flexibility to invest in companies large and small across the capital structure through both standard and highly customized structures. At its core, HPS shares a common thread of intellectual rigor and investment discipline that enables it to create value for its clients, who have entrusted HPS with approximately $149 billion of assets under management as of December 31, 2024. |

HPS is a leading provider of credit solutions to middle and upper middle market companies. Since its inception in 2007, HPS has committed approximately $170 billion in privately originated transactions across more than 890 investments.

3

We benefit from the following key competitive strengths of HPS in pursuing our investment strategy:

| |

• |

|

Scaled Capital with an Ability to Speak for the Full Debt Quantum . Scaled capital has been a key factor in capturing investment opportunities for prior funds managed by HPS. The scale of the HPS Direct Lending platform, including managed accounts and similar investment vehicles, allows it to commit to loans of up to approximately $1 billion. HPS believes that there is a finite set of competitors who can provide and solely hold investments of this size and service these larger scale borrowers. HPS believes that many borrowers in this segment value the confidentiality, efficiency and execution certainty available in the private credit market. HPS also believes that being the sole or majority investor in a debt tranche can also provide the funds it or its affiliates advise with enhanced downside protection. Additionally, due to favorable competitive dynamics with fewer capital providers with the ability to deliver scaled capital solutions, HPS believes that the HPS Direct Lending platform has, to date, been successful in capturing attractive risk-adjusted returns for providing solutions to large, more diversified borrowers. Having the scale to provide a complete capital solution to larger borrowers has also been an important factor in HPS’s ability to make investments in an increasingly competitive market environment. |

|

3 |

As of December 31, 2024. Based on the total face value committed to private credit investments that are part of the Strategic Investment Partners strategy, Special Situations Opportunities strategy (private special situations investments), Specialty Direct Lending strategy, Core Senior Lending strategy, and any additional private credit investments made by one or more business development companies, private credit CLOs, separately managed funds or accounts, or private credit-focused joint ventures, excluding investments that are solely part of the High Grade Corporate-Focused, High Grade Asset-Based, Real Estate, Asset Value, or Sustainability & Energy Transition strategies. |

| |

• |

|

Diversified Sourcing Network . HPS believes its diversified sourcing approach sets its platform apart from many of its peers. While the vast majority of peers focus their sourcing almost exclusively on financial sponsors and lending to businesses controlled by them, HPS has built an extensive relationship network across a breadth of private and public companies, management teams, banks, debt advisors, other financial intermediaries and financial sponsors. As a result, HPS has historically sourced a majority of its private credit investments from channels other than financial sponsors. 4 HPS believes that its ability to source from non-sponsor channels significantly reduces the competitive intensity and allows it to focus on structuring improved economics, stricter financial covenants and stronger loan documentation. In addition, direct dialogue with borrower management teams can result in a better understanding of the underlying borrowers and better positioning to actively manage investments throughout their life. HPS also actively engages with financial sponsors, and its exposure to sponsor transactions tends to increase in times of public market dislocation (when certainty of capital and speed of execution with a single counterparty is often sought after and highly valued). HPS believes that the ability to flex in and out of both sponsor and non-sponsor markets allows the Fund to remain nimble and optimize its opportunity set across different market dynamics. While HPS seeks to source investments from non-sponsor channels for the Fund, as of December 31, 2024, the Fund has sourced only a minority of its overall private credit investments from non-sponsor channels. The Fund may not, in the future, obtain its desired allocation to investments from the non-sponsor channel, which could adversely impact returns. |

| |

• |

|

Breadth of HPS’s Credit Investment Platform . HPS is a global alternative investment firm with strategies that seek to capitalize on non-investment grade credit opportunities across the capital structure. As a multi-strategy credit platform, seeking opportunities across both private and liquid credit, HPS employs an open-architecture framework under which investment teams can apply shared knowledge and insights when evaluating new investment opportunities. HPS’s team of more than 250 investment professionals managed approximately $149 billion as of December 31, 2024. HPS believes that its multi-strategy approach provides a differentiated vantage point to evaluate relative value and better positions the firm to provide borrowers with a comprehensive and diverse set of potential financing solutions, which may, in turn, enable the Fund to see more investment opportunities. In addition, HPS believes that its global footprint enables the Fund to view and potentially benefit from relative value opportunities across geographies. |

| |

• |

|

Willingness to Navigate Complexity to Evaluate a Mispriced Opportunity. HPS believes that its willingness to embrace complexity, such as complicated business models, esoteric underlying collateral, strained capital structures, and/or timing pressures, is a key differentiating factor relative to its competitors. In these situations, risk is often mispriced by the market, which HPS believes may offer a disproportionate return opportunity as there may be fewer willing lenders with the requisite expertise to underwrite these investment opportunities and borrowers tend to be more willing to pay for secured financing. HPS seeks to use its understanding of market structures to pursue these investment opportunities, identifying structures or deal dynamics that dissuade competing capital that view the opportunities as more “complex.” HPS believes that addressing complexity through creative pricing and structure can generate potential investment opportunities that can offer attractive, uncorrelated |

|

4 |

As of December 31, 2024. Based on the total face value committed to private credit investments that are part of the Specialty Direct Lending strategy, Core Senior Lending strategy, and any additional private credit investments made by one or more business development companies, private credit CLOs, separately managed funds or accounts, or private credit-focused joint ventures, excluding investments that are solely part of the Strategic Investment Partners, Special Situations Opportunities (private special situations investments), High Grade Corporate-Focused, High Grade Asset-Based, Real Estate, Asset Value, or Sustainability & Energy Transition strategies. The Fund had a lower percentage of private credit investments sourced from channels other than financial sponsors as of December 31, 2024. There is no guarantee that the Fund will be able to source a similar or higher percentage of private credit investments from channels other than financial sponsors. |

| |

returns taking into account the additional work required. Leveraging HPS’s multi-strategy approach to credit may provide the Fund with distinctive vantage points in determining the relative value of and appropriate pricing for, an investment opportunity in light of the risk. HPS believes that the capability to navigate complexity to identify potentially mispriced investment opportunities is important in volatile and uncertain investment environments. |

| |

• |

|

Focus on the Upper Middle Market . The HPS Direct Lending platform generally targets the upper-end of the middle market. As HPS believes that the market is in its later stages of the existing credit cycle, the Adviser intends to focus its portfolio on larger, more resilient companies that generally generate $75 million to $1 billion of EBITDA annually or $250 million to $5 billion in revenue annually. In comparison, the S&P LCD definition of middle market is defined as companies with $50 million of EBITDA or less. HPS believes the upper end of the middle market can offer greater downside protection, as larger businesses typically possess the benefits of scale and a greater critical mass through diversification of customers and suppliers. HPS believes that it can generally negotiate commensurate or better terms with respect to borrowers in the upper middle market segment and that those borrowers can provide us with increased downside protection, potentially resulting in attractive risk-adjusted returns compared to the smaller-end and core-middle market. |

| |

• |

|

Emphasis on Capital Preservation. Capital preservation is a core component of HPS’s investment philosophy. In addition to its focus on stable, established upper middle market companies, HPS employs a highly selective and rigorous ‘‘private equity-like’’ diligence and investment evaluation process focused on identification of potential risks, when evaluating its directly originated investments. HPS believes tight credit structuring is a fundamental part of the risk and recovery calculus, as the illiquidity in private credit means that secondary market liquidity is not a reliable risk mitigant. HPS has also built a deep bench of restructuring, workout and value enhancement professionals with an average of 28 years as of December 31, 2024, of workout experience, who work on an integrated basis to actively manage each investment throughout its life. |

|

What is the market opportunity? |

|

Private credit as an asset class has grown considerably since the global financial crisis of 2008, and it is estimated that the total market size of private credit has grown to reach $1.6 trillion as of December 31, 2024. 5 We expect this growth to continue and, along with the factors outlined below, to provide a robust backdrop to what HPS believes will be a significant number of attractive investment opportunities aligned to our investment strategy. |

| |

• |

|

Senior Secured Loans Offer Attractive Investment Characteristics . HPS believes that senior secured loans benefit from their relative priority position, typically sitting as the most senior obligation in an issuer’s capital structure, often with a direct security interest in the issuer’s (or its subsidiaries’) assets. Senior secured loans generally offer floating rate cash interest coupons that HPS believes can be an attractive return attribute in an elevated interest rate environment. In addition to a current income component, senior secured loans typically include original issue discount, closing payments, commitment fees, Secured Overnight Financing Rate (“SOFR”) (or similar rate) floors, call protection, and/or prepayment penalties and related fees that are additive components of total return. The relative seniority and security of senior secured loans, coupled with the privately negotiated nature of direct lending, help mitigate downside risk. |

| |

• |

|

Regulatory Actions Continue to Drive Demand towards Private Financing. The direct lending market has seen notable growth and has become a viable alternative solution for middle to upper middle market borrowers seeking financing capital. Global regulatory actions that followed the 2008 financial crisis have significantly increased the cost of capital requirements for commercial banks, limiting the willingness of commercial banks to originate and retain illiquid, non-investment grade credit |

|

5 |

Source: Preqin, Preqin Special Report: The Future of Alternatives in 2029. Data as of December 31, 2024. |

| |

commitments on their balance sheets, particularly with respect to middle and upper middle market-sized issuers. Instead, many commercial banks have adopted an “underwrite-and-distribute” approach, which HPS believes is often less attractive to corporate borrowers seeking certainty of capital. As a result, commercial banks’ share of the leveraged loan market declined from approximately 71% in 1994 to less than 25% in 2022 6 . Access to the syndicated leveraged loan market has also become challenging for both first time issuers and smaller scale issuers, who previously had access to the capital markets. Issuers of tranche sizes representing less than $500 million account for approximately 5% of the new issue market in 2024 as compared to over 49% in 2000 7 . HPS believes that these regulatory actions have caused a shift in the role that commercial banks play in the direct lending market for middle to upper middle market borrowers, creating a void in the financing marketplace. This void has been filled by direct lending platforms which seek to provide borrowers an alternative “originate and retain” solution. In response, corporate borrower behavior has increasingly shifted to a more conscious assessment of the benefits that direct lending platforms of strategic financing partners can offer. |

| |

• |

|

Volatility in Credit Markets has made Availability of Capital Less Predictable. HPS believes that the value of direct lending platforms for borrowers hinges on providing certainty of capital at a fair economic price. Volatility in the credit markets, coupled with changes to the regulatory framework over the past several years, has resulted in an imbalance between the availability of new loans to middle market borrowers and the demand from borrowers requiring capital for acquisitions, capital expenditures, recapitalizations, refinancings and restructurings. HPS believes that the scarcity of the supply of traditional loan capital relative to the demand has created an environment where direct lenders can often negotiate loans with attractive returns and creditor protections compared to public markets. |

| |

• |

|